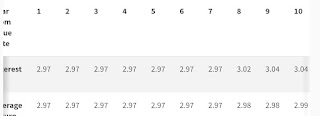

This month average 2.99% interest for 10 years duration is not bad!

Application Start from 3rd July to 26th July

I have been redeeming the old batch from 2018 and 2019 and re-apply for higher interest %.

This is the best option/flexibility for SSB.

Results is out for July SSB. All fully alloted!

Is under subscription for the total issurance of 600m.

Singapore Saving Bond - one of the best option to park your cash to earn a higher interest that spread across 10 years.

This month bond offering start from 1st June 6pm onwards to 26 June 2023 9pm.

Interest payment will be reflected as CDP-SBJUL23 in your bank statement

GX23070H in your SRS statement.

A safe and flexible way to save for the long term

The monthly issuance size of the Singapore Savings Bond (SSB) programme is S$600 million for this month. For more details, refer to the media release.

At the end of each year, on a compounded basis.

http://www.sgs.gov.sg/savingsbonds/Your-SSB/This-months-bond.aspx

Application may apply through: DBS/POSB, OCBC and UOB ATMs and Internet Banking and SRS. CPF funds are not eligible.

Invest amount : You can invest a minimum of $500, and in multiples of $500. The total amount of Savings Bonds held across all issues cannot be more than $200,000.

Interest Payment dates : Upcoming payment: 01 Jan 2024

Subsequent payments (until maturity): Every 6 months on 01 Jul and 01 Jan

Each Savings Bond has a term of 10 years and pays interest every 6 months. Savings Bonds cannot be traded like conventional bonds or shares. Interest income is exempt from tax. Only individuals above 18 years old can apply.

Savings Bonds are fully backed by the Singapore Government. And because the bonds can always be redeemed for the full amount invested, investors are protected against capital losses when interest rates change. This makes them one of the safest possible investments for individuals to hold.

Save up to 10 years, and earn interest that “steps up” or increases over time. Hold your Savings Bond for the full 10 years and receive an average interest per year that matches the return from 10-year Singapore Government Securities yields, which has generally been between 2%-3%.

Flexible :

Or, choose to exit your investment in any given month, with no penalties. There is no need to decide on a specific investment period at the start.

No comments:

Post a Comment