Today new PO share has been credited to your account, quickly check ti find out the correct no of share has been deposited to your account.

PO price 1.06. Now trading at 1.14, already can book a nice profit of 8 cents, is quite good!

Chart wise, bullish mode!

Likely to cross over 1.15 smoothly and rises up ti test 1.21 than 1.24.

Huat ah!

Please dyodd.

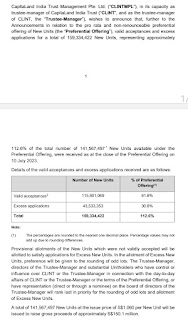

PO results is out!

The new share will be deposited on your account on 18th July.

The current price of 1.14 is trading higher than the PO price of 1.06.

I think many might have taken the opportunity to lock in profit!

Please dyodd.

PO officially closed at 5.30pm on 10th July 2023.

New share will be credited and start trading on 18th July.

First half year results cum dividend will be announced on 30th July before trading commence!

I have applied by rounding the share to even lot number.

All the best to those who has applied including excess!

Today share price close at 1.12. Looks like uptrend is still intact!

Please dyodd.

Preferential Offering of share at 1.06 per unit.

PO exercise date from 30th June to 10th July

5.30pm.

Every 1000 share you are entitled 119 unit of share.

If you hold 5000 share, you are eligible to apply for 547 unit at 1.06 per share.

You may choose to apply together with excess to make it an even lot number for example 600 share or 1000 share.

The new share will be credited to your account on 18 July 2023.

Good luck!

Please dyodd.

Chart wise, bullish mode!

Likely to continue to trend higher!

Short term wise, a nice breakout of 1.14 smoothly may likely see her rising up to test 1.21.

Yearly dividend of about 8.3 cents.

Yield is about 7.28%

NAV 1.08.

CapitaLand India Trust (CLINT), formerly known as Ascendas India Trust, was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in August 2007 as the first Indian property trust in Asia. Its principal objective is to own income-producing real estate used primarily as business space in India. CLINT may also develop and acquire land or uncompleted developments primarily to be used as business space, with the objective of holding the properties upon completion. As at 12 May 2023, CLINT’s assets under management stand at S$2.7 billion.

CLINT’s portfolio includes nine world-class IT business parks, one logistics park, one industrial facility and four data centre developments in India, with total completed floor area of 19.2 million square feet spread across Bangalore, Chennai, Hyderabad, Pune and Mumbai. CLINT is focused on capitalising on the fast-growing IT industry and industrial/logistics asset classes in India, as well as proactively diversifying into other new economy asset class such as data centres.

CLINT is structured as a business trust, offering stable income distributions similar to a real estate investment trust. CLINT focuses on enhancing shareholder value by actively managing existing properties, developing vacant land in its portfolio, and acquiring new properties.

CLINT is managed by CapitaLand India Trust Management Pte. Ltd., formerly known as Ascendas Property Fund Trustee Pte. Ltd. The trustee-manager is a wholly owned subsidiary of Singapore-listed CapitaLand Investment Limited, a leading global real estate investment manager with a strong Asia foothold.

Our business parks offer a distinct business lifestyle where convenience and comfort meet productivity. Lush greenery and modern architecture create an exciting landscape that inspires knowledge workers, while an impressive array of amenities is designed to enhance the working experience. From sports, medical and childcare facilities to restaurants and cafes, our thoughtfully curated range of services cater to all professional needs. We have also seamlessly integrated technology and sustainable practices throughout our parks, from energy-efficient buildings to smart infrastructure, minimizing our environmental impact while maximizing efficiency.

Data Centres

We are developing 4 data centres in India’s key data centre markets – Navi Mumbai, Hyderabad, Chennai, and Bangalore. As at second quarter 2023, construction of the data centres in Navi Mumbai and Hyderabad have commenced. When fully developed, the four state-of-the-art data centres will deliver a total power capacity of 244 MW. Our data centres adopt sustainable design principles and green building standards, including features such as intelligent energy management systems, solar panels, and highly efficient cooling systems using low global warming potential refrigerant.

Our industrial facility is a premier Grade A asset, fully leased to a multinational electronics manufacturer. It is situated in Mahindra World City, a renowned industrial micro-market known for its blue-chip occupants.

Our logistics asset consists of seven modern and high-quality warehouses ensuring efficient and seamless logistics operations. It is situated in Panvel, a well-established and strategic warehousing zone that provides convenient access to India's largest container port, the Jawaharlal Nehru Port Trust.

No comments:

Post a Comment