Chart wise, looks bullish!

Likely to continue to trend higher!

The current price of 72.5 cents is staying above its SMA lines & RSI is still rising up nicely high chance it may likely continue to rise furhter!

Short term wise, I think a nice breakout of 73 cents plus good volume that may likely drive the price higher towards 76 then 80 with extension to 84 cents.

Pls dyodd.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.13% based on current price of 72.5 cents.

Not a call to buy or sell.

https://spore-share.com or sporeshare.blogspot.com It is very important to equip and educate ourselves with the Trading or investing knowledge. Don’t rely on tips! Ensure we have a proper plan in place whenever we enter a trade. Don’t speculate and trade without knowing what you are trying to achieve. Only trade when the trading opportunity arise. All information provided is just just for sharing. (Trade/Invest base on your own decision!)

Wednesday, April 29, 2020

LendLease

Chart wise, looks bullish!

Likely to continue to trend higher!

Short term wise, I think a nice breakout at 61 cents plus good volume that may likely retest the recent high of 64 cents.

Crossing over 64 cents with ease plus high volume that may likely drive the price higher towards 68 then 70 cents.

Pls dyodd.

Chart wise, we have witnessed the drastic selling down taken place from 90 cents to touch the low of 44 cents, more than 50% being wipe off since the IPO offered price of 88 cents in Oct 2019, seems extremely oversold!

The price action has warranted a rebound and recovered from 44 cents to close higher at 61 cents, looks quite positive.

NAV 82.1 cents.

Dividend is about 5 cents.

Yield is 8.19%

Short term wise, I think a nice breakout of 63.5 cents plus high volume that may likely drive the price higher towards 68 cents then 70 cents with extension to 78 cents.

Not a call to buy or sell.

Pls dyodd.

The recent announcement dated 9th April 2020:

Sky Italia, which leases 100% of Sky Complex, has to-date made all its rental payments in a timely manner as per its lease and it contributes 33.9% of LREIT’s net property income1 . Sky Italia is wholly owned by Comcast Corporation, the world’s largest broadcasting and cable television company by revenue2 rated A3 with a stable outlook by Moody’s Investors Service, Inc.

To ensure financial stability and cashflow sustainability, LREIT adopts a prudent and disciplined approach towards capital management. As at 31 December 2019, LREIT had a gearing ratio of 34.9% and a cash balance of S$88.5 million. Its weighted average running cost of debt was 0.86% per annum with an interest coverage ratio at 10.8 times. LREIT’s borrowings are 100% hedged with no debt maturities until its financial year ending 30 June 2023. Its weighted average debt maturity was 3.6 years

The Covid-19 pandemic has worsened globally, including in Singapore. Given the various measures introduced by the Singapore government, there will be an impact on 313@somerset’s contribution to LREIT’s distributable income from April 2020 onwards as compared against the profit and distribution forecast set out in LREIT’s IPO prospectus.

quote :https://links.sgx.com/FileOpen/Lendlease%20-%20Update%20on%20the%20Impact%20of%20the%20Covid-19%20Outbreak%20-%209%20April%202020.ashx?App=Announcement&FileID=605955

Likely to continue to trend higher!

Short term wise, I think a nice breakout at 61 cents plus good volume that may likely retest the recent high of 64 cents.

Crossing over 64 cents with ease plus high volume that may likely drive the price higher towards 68 then 70 cents.

Pls dyodd.

Chart wise, we have witnessed the drastic selling down taken place from 90 cents to touch the low of 44 cents, more than 50% being wipe off since the IPO offered price of 88 cents in Oct 2019, seems extremely oversold!

The price action has warranted a rebound and recovered from 44 cents to close higher at 61 cents, looks quite positive.

NAV 82.1 cents.

Dividend is about 5 cents.

Yield is 8.19%

Short term wise, I think a nice breakout of 63.5 cents plus high volume that may likely drive the price higher towards 68 cents then 70 cents with extension to 78 cents.

Not a call to buy or sell.

Pls dyodd.

The recent announcement dated 9th April 2020:

Sky Italia, which leases 100% of Sky Complex, has to-date made all its rental payments in a timely manner as per its lease and it contributes 33.9% of LREIT’s net property income1 . Sky Italia is wholly owned by Comcast Corporation, the world’s largest broadcasting and cable television company by revenue2 rated A3 with a stable outlook by Moody’s Investors Service, Inc.

To ensure financial stability and cashflow sustainability, LREIT adopts a prudent and disciplined approach towards capital management. As at 31 December 2019, LREIT had a gearing ratio of 34.9% and a cash balance of S$88.5 million. Its weighted average running cost of debt was 0.86% per annum with an interest coverage ratio at 10.8 times. LREIT’s borrowings are 100% hedged with no debt maturities until its financial year ending 30 June 2023. Its weighted average debt maturity was 3.6 years

The Covid-19 pandemic has worsened globally, including in Singapore. Given the various measures introduced by the Singapore government, there will be an impact on 313@somerset’s contribution to LREIT’s distributable income from April 2020 onwards as compared against the profit and distribution forecast set out in LREIT’s IPO prospectus.

quote :https://links.sgx.com/FileOpen/Lendlease%20-%20Update%20on%20the%20Impact%20of%20the%20Covid-19%20Outbreak%20-%209%20April%202020.ashx?App=Announcement&FileID=605955

Genting Sing

Chart wise, looks bullish!

Likely to continue to trend higher!

The current price of 78 cents is staying above its SMA lines ,high chance it may likely breakout the resistance at 78 cents and rises higher towards 83 cents.

Crossing over of 83 cents smoothly plus high volume that may likely drive the price higher towards 90 cents.

Not a call to buy or sell.

Pls dyodd.

Likely to continue to trend higher!

The current price of 78 cents is staying above its SMA lines ,high chance it may likely breakout the resistance at 78 cents and rises higher towards 83 cents.

Crossing over of 83 cents smoothly plus high volume that may likely drive the price higher towards 90 cents.

Not a call to buy or sell.

Pls dyodd.

Aims Apac reit

Chart wise, after touching the low of 90 cents it has since recovered and rises higher to close at $1.15 seems rather positive!

Short term wise, I think it may likely move up to retest the recent high of $1.20.

Breaking out plus high volume that may likely drive the price higher towards $1.30.

NAV $1.365

Dividend of 9 cents

Yield is 7.8%

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think it may likely move up to retest the recent high of $1.20.

Breaking out plus high volume that may likely drive the price higher towards $1.30.

NAV $1.365

Dividend of 9 cents

Yield is 7.8%

Not a call to buy or sell.

Pls dyodd.

Tuesday, April 28, 2020

DBS Group

1st quarter result is out!

Solid! Total income rises 13% crosses 4 billion . Profit before allowance is up 20%.

A provision of $703m was set aside for bad debts. Net profit is down 29% to $1.17b.

Dividend of 33 cents maintain.

Nice set of result.

Pls dyodd.

Chart wise, looks like it is doing a reversal mode chart patterns, likely to continue to trend higher!

The current price of $19.15 is staying above its EMA 20 and SMA 20, looks rather positive and may likely continue to rise further.

Short term wise, I think a nice breakout of $19.35 plus high volume that may likely propel to drive the price higher towards $20.00 with extension to $21.00.

First quarter result is due tomorrow before trading commence.

All eyes are waiting for further insights whether is there any decrease in quarterly dividend and update for the current market saga and oil price issue.

Not a call to buy or sell.

Pls dyodd.

Solid! Total income rises 13% crosses 4 billion . Profit before allowance is up 20%.

A provision of $703m was set aside for bad debts. Net profit is down 29% to $1.17b.

Dividend of 33 cents maintain.

Nice set of result.

Pls dyodd.

Chart wise, looks like it is doing a reversal mode chart patterns, likely to continue to trend higher!

The current price of $19.15 is staying above its EMA 20 and SMA 20, looks rather positive and may likely continue to rise further.

Short term wise, I think a nice breakout of $19.35 plus high volume that may likely propel to drive the price higher towards $20.00 with extension to $21.00.

First quarter result is due tomorrow before trading commence.

All eyes are waiting for further insights whether is there any decrease in quarterly dividend and update for the current market saga and oil price issue.

Not a call to buy or sell.

Pls dyodd.

CMT

Wah lau, crawling up very slowly!

Still waiting neck long long for $1.80 to come.

Let's see will it hAppen by end of the day!

Pls dyodd.

Chart wise, looks like a reversal play mode!

Short term wise, I think likely to move up to test $1.80 again!

Breaking out plus high volume that may likely retest $1.90 level.

Pls dyodd.

Looks like current price of $1.68 is getting interesting again!

Trading at P/B of 0.8.

NAV $2.10

Yield of 6.54% base on dividend of 11 cents, seem quite attractive!

Last Friday looks like closing with a hammer candlestick chart pattern and hopefully we can see a rebound from here!

A nice breakout of $1.84 coupled with high volume that may likely drive the price higher towards $1.90 then $2.00 .

Not a call to buy or sell.

Pls dyodd.

Still waiting neck long long for $1.80 to come.

Let's see will it hAppen by end of the day!

Pls dyodd.

Chart wise, looks like a reversal play mode!

Short term wise, I think likely to move up to test $1.80 again!

Breaking out plus high volume that may likely retest $1.90 level.

Pls dyodd.

Looks like current price of $1.68 is getting interesting again!

Trading at P/B of 0.8.

NAV $2.10

Yield of 6.54% base on dividend of 11 cents, seem quite attractive!

Last Friday looks like closing with a hammer candlestick chart pattern and hopefully we can see a rebound from here!

A nice breakout of $1.84 coupled with high volume that may likely drive the price higher towards $1.90 then $2.00 .

Not a call to buy or sell.

Pls dyodd.

CapitaMall trust

Chart wise, looks like a reversal play mode!

Short term wise, I think likely to move up to test $1.80 again!

Breaking out plus high volume that may likely retest $1.90 level.

Pls dyodd.

Looks like current price of $1.68 is getting interesting again!

Trading at P/B of 0.8.

NAV $2.10

Yield of 6.54% base on dividend of 11 cents, seem quite attractive!

Last Friday looks like closing with a hammer candlestick chart pattern and hopefully we can see a rebound from here!

A nice breakout of $1.84 coupled with high volume that may likely drive the price higher towards $1.90 then $2.00 .

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think likely to move up to test $1.80 again!

Breaking out plus high volume that may likely retest $1.90 level.

Pls dyodd.

Looks like current price of $1.68 is getting interesting again!

Trading at P/B of 0.8.

NAV $2.10

Yield of 6.54% base on dividend of 11 cents, seem quite attractive!

Last Friday looks like closing with a hammer candlestick chart pattern and hopefully we can see a rebound from here!

A nice breakout of $1.84 coupled with high volume that may likely drive the price higher towards $1.90 then $2.00 .

Not a call to buy or sell.

Pls dyodd.

Monday, April 27, 2020

ST Engineering

Chart wise, it is doing a reversAl chart patterns after touching the low of $2.93 to close higher at $3.24, looks pretty interesting!

Short term wise, I think a nice breakout of $3.30 coupled with high volume that may likely drive the price higher towards $3.40 then $3.50 level.

Yearly Dividend of 15 cents .

Yield of 4.65%.

CD 10 cents. XD 20 May.

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think a nice breakout of $3.30 coupled with high volume that may likely drive the price higher towards $3.40 then $3.50 level.

Yearly Dividend of 15 cents .

Yield of 4.65%.

CD 10 cents. XD 20 May.

Not a call to buy or sell.

Pls dyodd.

Sunday, April 26, 2020

Frasers L&I tr

Chart wise, looks like it has taken a breather after hitting the high of $1.05 to close lower at 98 cents looks pretty interesting!

Short term wise, I think it may likely move up to retest $1.05 again.

Breaking out of this level plus high volume that may likely drive the price high towards $1.08 then $1.10 with extension to $1.20.

NAV 95 cents.

Dividend of 6.5 cents.

Yield is 6.7%

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think it may likely move up to retest $1.05 again.

Breaking out of this level plus high volume that may likely drive the price high towards $1.08 then $1.10 with extension to $1.20.

NAV 95 cents.

Dividend of 6.5 cents.

Yield is 6.7%

Not a call to buy or sell.

Pls dyodd.

Saturday, April 25, 2020

Frasers CPT tr

Chart wise, looks bearish!

I think the same chart patterns may repeat itself again!

Short term wise, I think it may go down to retest $1.90 again!

Breaking down of $1.90 plus high volume that may likely see further selling down pressure towards $1.80 then $1.73 with extension to $1.59 .

Not a call to buy or sell.

Pls dyodd.

I think the same chart patterns may repeat itself again!

Short term wise, I think it may go down to retest $1.90 again!

Breaking down of $1.90 plus high volume that may likely see further selling down pressure towards $1.80 then $1.73 with extension to $1.59 .

Not a call to buy or sell.

Pls dyodd.

CapitaMall trust

Looks like current price of $1.68 is getting interesting again!

Trading at P/B of 0.8.

NAV $2.10

Yield of 6.54% base on dividend of 11 cents, seem quite attractive!

Last Friday looks like closing with a hammer candlestick chart pattern and hopefully we can see a rebound from here!

A nice breakout of $1.84 coupled with high volume that may likely drive the price higher towards $1.90 then $2.00 .

Not a call to buy or sell.

Pls dyodd.

Trading at P/B of 0.8.

NAV $2.10

Yield of 6.54% base on dividend of 11 cents, seem quite attractive!

Last Friday looks like closing with a hammer candlestick chart pattern and hopefully we can see a rebound from here!

A nice breakout of $1.84 coupled with high volume that may likely drive the price higher towards $1.90 then $2.00 .

Not a call to buy or sell.

Pls dyodd.

Thursday, April 23, 2020

STI

Chart wise, looks rather bearish!

After touching the high of 2671 it has been corrected quite a bit to touch the low of 2501 before bouncing off to trade at 2521 looks rather weak!

Short term wise, a breaking down of 2501 plus high volume that may likely see further selling down pressure to slide down towards 2400 with extension to 2300 level

Not a call to buy or sell.

Pls dyodd.

After touching the high of 2671 it has been corrected quite a bit to touch the low of 2501 before bouncing off to trade at 2521 looks rather weak!

Short term wise, a breaking down of 2501 plus high volume that may likely see further selling down pressure to slide down towards 2400 with extension to 2300 level

Not a call to buy or sell.

Pls dyodd.

OCBC Bank

Chart wise, looks like forming a series of higher high and higher low,seems positive.

The current price of $8.65 is hovering near the 20MA line and a nice breakout to reclaimed this 20 MA line at about $8.77 would certainly lift the price higher towards $9.00 & above.

NAV $10.39.

Dividend of 53 cents

Yield is 6.1%

Looks pretty attractive as it it trading below its book value plus 6% yield.

Not a call to buy or sell.

Pls dyodd

The current price of $8.65 is hovering near the 20MA line and a nice breakout to reclaimed this 20 MA line at about $8.77 would certainly lift the price higher towards $9.00 & above.

NAV $10.39.

Dividend of 53 cents

Yield is 6.1%

Looks pretty attractive as it it trading below its book value plus 6% yield.

Not a call to buy or sell.

Pls dyodd

Tuesday, April 21, 2020

MAple Comm Trust

Chart wise, looks bearish!

I think market is giving us plentype of opportunity to exit or lock in profit!

With the circuit breaker ,I think retail side may be affected even after it has been lifted. Their NPI may come in quite a big % from retail and DPU for the next quarter might be much lowered!

NAV $1.76. Yield is 4+%.

Short term wise, I think if $1.79 is being broken down then it may likely go lower to test $1.70 then $1.60 with extension to $1.50 level. Not a call to buy or sell. Pls dyodd.

With the circuit breaker ,I think retail side may be affected even after it has been lifted. Their NPI may come in quite a big % from retail and DPU for the next quarter might be much lowered!

NAV $1.76. Yield is 4+%.

Short term wise, I think if $1.79 is being broken down then it may likely go lower to test $1.70 then $1.60 with extension to $1.50 level. Not a call to buy or sell. Pls dyodd.

Monday, April 20, 2020

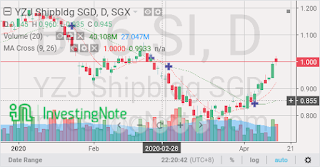

YZJ

Chart wise, the running up is too steep + rejecting the resistance at $1.07 coupled with high volume, looks like big boys has already exited!

Two doji for the next two trading days seems like it is doubtful of the recent running up!

Short term wise, a breaking down of 98 cents would see further selling down pressure!

Likely to go lower to test 90 cents with further sliding down towards 80.

As oil demand slow down, many shipping or logistics shipments may also badly affected as cargoes volume may be much lowered .

Not a call to buy or sell.

Pls dyodd.

Two doji for the next two trading days seems like it is doubtful of the recent running up!

Short term wise, a breaking down of 98 cents would see further selling down pressure!

Likely to go lower to test 90 cents with further sliding down towards 80.

As oil demand slow down, many shipping or logistics shipments may also badly affected as cargoes volume may be much lowered .

Not a call to buy or sell.

Pls dyodd.

Food empire

Chart wise, looks like having a temporary rebound after touching the low of 41.5 cents.

The current price of 52.5 cents is trading at PE of 7.5x looks pretty undervalued.

Short term wise, a breakout of the recent high of 56 cents would likely drive the price higher towards 60 then 70.

Dividend of 2 cents XD on 30 April.

Not a call to buy or sell.

Pls dyodd.

The current price of 52.5 cents is trading at PE of 7.5x looks pretty undervalued.

Short term wise, a breakout of the recent high of 56 cents would likely drive the price higher towards 60 then 70.

Dividend of 2 cents XD on 30 April.

Not a call to buy or sell.

Pls dyodd.

Sunday, April 19, 2020

DBS Group

Chart wise, looks rather interesting!

It has managed to bounce-off from the lower Trend Line at about $19.01 and rises higher to hit $19.21 , looks rather positive!

The current price of $19.21 is staying above it 20 days MA looks like the worst might be over!

Short term wise, a nice breakout of the recent high of $20.06 price level plus high volume that may drive the price higher towards $20.35 then $21.00 with extension to $22.35.

Dividend of 33 cents per quarter.

Recent analyst has been projecting dividend might be cut for the coming quarter result on 30th April to 30 cents per quarter.

Let's say the yearly dividend of $1.20, Yield is still pretty high at 6.24% based on the current price of $19.21.

I think is difficult to catch the bottoming price. Is good to have a proper investment plan in place.

Not a call to buy or sell.

Pls dyodd.

It has managed to bounce-off from the lower Trend Line at about $19.01 and rises higher to hit $19.21 , looks rather positive!

The current price of $19.21 is staying above it 20 days MA looks like the worst might be over!

Short term wise, a nice breakout of the recent high of $20.06 price level plus high volume that may drive the price higher towards $20.35 then $21.00 with extension to $22.35.

Dividend of 33 cents per quarter.

Recent analyst has been projecting dividend might be cut for the coming quarter result on 30th April to 30 cents per quarter.

Let's say the yearly dividend of $1.20, Yield is still pretty high at 6.24% based on the current price of $19.21.

I think is difficult to catch the bottoming price. Is good to have a proper investment plan in place.

Not a call to buy or sell.

Pls dyodd.

Saturday, April 18, 2020

CApital Mall trust

Chart wise, looks rather bullish!

A nice breakout of $1.90 coupled with high volume that would likely drive the price higher towards $2.00 then $2.10 with extension to $2.20.

Result will be out on 30 April morning, all eyes will be closely monitored how much DPU they are going to payout! If DPU drop more than 50% then can expect to see a reverse in price action.

Not a call to buy or sell.

Pls dyodd.

Looks like she has found her bottom and bounce off nicely from $1.49 to trade higher at $1.77 level, looks positive!

Short term wise, I think a nice breakout of the recent high of $1.84 would likely bring the price higher towards 1.90 then $2.00.

I think once the current market sentiment improve,she would likely be trading above $2.00.

NAV $2.105.

Lets say DPU drop to 11 cents from 12.2 cents , yield is about 6.2% for this blue chips reit counter, looks quite attractive!

Not a call to buy or sell.

Pls dyodd.

A nice breakout of $1.90 coupled with high volume that would likely drive the price higher towards $2.00 then $2.10 with extension to $2.20.

Result will be out on 30 April morning, all eyes will be closely monitored how much DPU they are going to payout! If DPU drop more than 50% then can expect to see a reverse in price action.

Not a call to buy or sell.

Pls dyodd.

Looks like she has found her bottom and bounce off nicely from $1.49 to trade higher at $1.77 level, looks positive!

Short term wise, I think a nice breakout of the recent high of $1.84 would likely bring the price higher towards 1.90 then $2.00.

I think once the current market sentiment improve,she would likely be trading above $2.00.

NAV $2.105.

Lets say DPU drop to 11 cents from 12.2 cents , yield is about 6.2% for this blue chips reit counter, looks quite attractive!

Not a call to buy or sell.

Pls dyodd.

Friday, April 17, 2020

LendLease

Chart wise, we have witnessed the drastic selling down taken place from 90 cents to touch the low of 44 cents, more than 50% being wipe off since the IPO offered price of 88 cents in Oct 2019, seems extremely oversold!

The price action has warranted a rebound and recovered from 44 cents to close higher at 61 cents, looks quite positive.

NAV 82.1 cents.

Dividend is about 5 cents.

Yield is 8.19%

Short term wise, I think a nice breakout of 63.5 cents plus high volume that may likely drive the price higher towards 68 cents then 70 cents with extension to 78 cents.

Not a call to buy or sell.

Pls dyodd.

The recent announcement dated 9th April 2020:

Sky Italia, which leases 100% of Sky Complex, has to-date made all its rental payments in a timely manner as per its lease and it contributes 33.9% of LREIT’s net property income1 . Sky Italia is wholly owned by Comcast Corporation, the world’s largest broadcasting and cable television company by revenue2 rated A3 with a stable outlook by Moody’s Investors Service, Inc.

To ensure financial stability and cashflow sustainability, LREIT adopts a prudent and disciplined approach towards capital management. As at 31 December 2019, LREIT had a gearing ratio of 34.9% and a cash balance of S$88.5 million. Its weighted average running cost of debt was 0.86% per annum with an interest coverage ratio at 10.8 times. LREIT’s borrowings are 100% hedged with no debt maturities until its financial year ending 30 June 2023. Its weighted average debt maturity was 3.6 years

The Covid-19 pandemic has worsened globally, including in Singapore. Given the various measures introduced by the Singapore government, there will be an impact on 313@somerset’s contribution to LREIT’s distributable income from April 2020 onwards as compared against the profit and distribution forecast set out in LREIT’s IPO prospectus.

quote :https://links.sgx.com/FileOpen/Lendlease%20-%20Update%20on%20the%20Impact%20of%20the%20Covid-19%20Outbreak%20-%209%20April%202020.ashx?App=Announcement&FileID=605955

The price action has warranted a rebound and recovered from 44 cents to close higher at 61 cents, looks quite positive.

NAV 82.1 cents.

Dividend is about 5 cents.

Yield is 8.19%

Short term wise, I think a nice breakout of 63.5 cents plus high volume that may likely drive the price higher towards 68 cents then 70 cents with extension to 78 cents.

Not a call to buy or sell.

Pls dyodd.

The recent announcement dated 9th April 2020:

Sky Italia, which leases 100% of Sky Complex, has to-date made all its rental payments in a timely manner as per its lease and it contributes 33.9% of LREIT’s net property income1 . Sky Italia is wholly owned by Comcast Corporation, the world’s largest broadcasting and cable television company by revenue2 rated A3 with a stable outlook by Moody’s Investors Service, Inc.

To ensure financial stability and cashflow sustainability, LREIT adopts a prudent and disciplined approach towards capital management. As at 31 December 2019, LREIT had a gearing ratio of 34.9% and a cash balance of S$88.5 million. Its weighted average running cost of debt was 0.86% per annum with an interest coverage ratio at 10.8 times. LREIT’s borrowings are 100% hedged with no debt maturities until its financial year ending 30 June 2023. Its weighted average debt maturity was 3.6 years

The Covid-19 pandemic has worsened globally, including in Singapore. Given the various measures introduced by the Singapore government, there will be an impact on 313@somerset’s contribution to LREIT’s distributable income from April 2020 onwards as compared against the profit and distribution forecast set out in LREIT’s IPO prospectus.

quote :https://links.sgx.com/FileOpen/Lendlease%20-%20Update%20on%20the%20Impact%20of%20the%20Covid-19%20Outbreak%20-%209%20April%202020.ashx?App=Announcement&FileID=605955

Thursday, April 16, 2020

DBS

Today I FOMO nibble a bit at $19.55 this morning!

NAV $19.28

CD 2nd May of 33 cents.

Short term wise, a nice breakout of the recent high of $20.02 plus good volume that may likely see the price rises higher towards $21.00 then $22.30 !

If this is happening then we are having a nice reversal chart patterns!

Not a call to buy or sell.

Pls dyodd.

11th April 2020

Chart wise, there is no clear indication of a reversal patterns yet!

Will it continues to rise further to move up to test $20 or freezer off and go down to retest $17.90 again! We will know the answer for the coming week.

I think market is still clouded with many uncertainty like fighting to contain the virus, economy may slip into recession etc.

Short term wise, there is no clear sign of market bottoming yet as the recent rebound is just the usual reaction after a drastic selling down effect.

I think is ok to stay sideline !

Stay safe and please take care!

Pls dyodd.

NAV $19.28

CD 2nd May of 33 cents.

Short term wise, a nice breakout of the recent high of $20.02 plus good volume that may likely see the price rises higher towards $21.00 then $22.30 !

If this is happening then we are having a nice reversal chart patterns!

Not a call to buy or sell.

Pls dyodd.

11th April 2020

Chart wise, there is no clear indication of a reversal patterns yet!

Will it continues to rise further to move up to test $20 or freezer off and go down to retest $17.90 again! We will know the answer for the coming week.

I think market is still clouded with many uncertainty like fighting to contain the virus, economy may slip into recession etc.

Short term wise, there is no clear sign of market bottoming yet as the recent rebound is just the usual reaction after a drastic selling down effect.

I think is ok to stay sideline !

Stay safe and please take care!

Pls dyodd.

Frasers Property

TA wise, looks rather bullish!

It has bounce-off from the double bottom chart patterns and managed to cleared the resistance at $1.21 to close higher at $1.24.

NAV $2.582.

PE of 7.4x.

Dividend of 6 cents.

Short term wise,I think it may likely move up to $1.30.

Breaking out of $1.30 plus good volume that may likely drive the price higher towards $1.40 level.

Not a call to buy or sell.

Pls dyodd.

It has bounce-off from the double bottom chart patterns and managed to cleared the resistance at $1.21 to close higher at $1.24.

NAV $2.582.

PE of 7.4x.

Dividend of 6 cents.

Short term wise,I think it may likely move up to $1.30.

Breaking out of $1.30 plus good volume that may likely drive the price higher towards $1.40 level.

Not a call to buy or sell.

Pls dyodd.

Wednesday, April 15, 2020

Suntec

Chart wise, she has managed to bounce-off from the low of $1.10 and rises higher to close at $1.31, looks rather positive!

Short term wise, I think a nice breakout of $1.36 plus high volume that may likely propel to drive the price higher towards 1.40 then 1.50 level.

NAV $2.126

P/B 0.616

Dividend let say drop to 8.8 cents. i.e. 2.2 cents per quarter, Yield is about 6.71% based on current price of $1.31, looks pretty attractive!

The recent Share Placement offered price was $1.80 per share.

We are now getting a good discounted price at $1.31.

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think a nice breakout of $1.36 plus high volume that may likely propel to drive the price higher towards 1.40 then 1.50 level.

NAV $2.126

P/B 0.616

Dividend let say drop to 8.8 cents. i.e. 2.2 cents per quarter, Yield is about 6.71% based on current price of $1.31, looks pretty attractive!

The recent Share Placement offered price was $1.80 per share.

We are now getting a good discounted price at $1.31.

Not a call to buy or sell.

Pls dyodd.

CapitaMall trust

Looks like she has found her bottom and bounce off nicely from $1.49 to trade higher at $1.77 level, looks positive!

Short term wise, I think a nice breakout of the recent high of $1.84 would likely bring the price higher towards 1.90 then $2.00.

I think once the current market sentiment improve,she would likely be trading above $2.00.

NAV $2.105.

Lets say DPU drop to 11 cents from 12.2 cents , yield is about 6.2% for this blue chips reit counter, looks quite attractive!

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think a nice breakout of the recent high of $1.84 would likely bring the price higher towards 1.90 then $2.00.

I think once the current market sentiment improve,she would likely be trading above $2.00.

NAV $2.105.

Lets say DPU drop to 11 cents from 12.2 cents , yield is about 6.2% for this blue chips reit counter, looks quite attractive!

Not a call to buy or sell.

Pls dyodd.

YZJ ShipBldg SGD

TA wise, looks like overly extended!

Likely to see some pulling back reaction from current price level of $1.00.

Short term wise, it may retrace back to 95 then 90 then 85 cents level.

Pls dyodd.

Likely to see some pulling back reaction from current price level of $1.00.

Short term wise, it may retrace back to 95 then 90 then 85 cents level.

Pls dyodd.

Sasseur Reit

It has a nice running up from 53 cents to close higher at 69.5 cents ,looks like overly stretch at this juncture!

Close with a topping tail candlestick seems like fund has managed to offload some of their gains!

I think we may see some selling down pressure!

It might be good to monitor and wait for clearer picture.

Pls dyodd.

Chart wise, it has a temporary rebound from the low of 53 cents to close higher at 62 cents, looks quite positive!

The major resistance is at 65 cents level.

A nice breakout plus high volume that may likely drive the price higher towards 70 then 72.5 cents with extension to 80 cents level.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.83% based on current price of 62 cents.

Not a call to buy or sell.

Pls dyodd.

Close with a topping tail candlestick seems like fund has managed to offload some of their gains!

I think we may see some selling down pressure!

It might be good to monitor and wait for clearer picture.

Pls dyodd.

Chart wise, it has a temporary rebound from the low of 53 cents to close higher at 62 cents, looks quite positive!

The major resistance is at 65 cents level.

A nice breakout plus high volume that may likely drive the price higher towards 70 then 72.5 cents with extension to 80 cents level.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.83% based on current price of 62 cents.

Not a call to buy or sell.

Pls dyodd.

Monday, April 13, 2020

SGX

Wah, when the STI market is bullish +70 points , she goes the opposite direction!

Down 22 cents to trade at $9.62.

yearly dividend of 30 cents.

Yield is merely 3.1%.

Looks pretty expensive!

I would rather go for OCBC Bank that is trading at $9.10, dividend of 53 cents, yield of 5.82%.

Let's wait for market to tell us the clear direction if she is going to breakdown the lower Trend Line that may see further selling down pressure!

She has a very impressive running up even though when the global stocks market is bearish!

I guess is the Big Boy that are controlling the driver seat!

Once they started to exit , we may see the clearer picture and direction of this counter.

Not a call to buy or sell.

Pls dyodd.

Down 22 cents to trade at $9.62.

yearly dividend of 30 cents.

Yield is merely 3.1%.

Looks pretty expensive!

I would rather go for OCBC Bank that is trading at $9.10, dividend of 53 cents, yield of 5.82%.

Let's wait for market to tell us the clear direction if she is going to breakdown the lower Trend Line that may see further selling down pressure!

She has a very impressive running up even though when the global stocks market is bearish!

I guess is the Big Boy that are controlling the driver seat!

Once they started to exit , we may see the clearer picture and direction of this counter.

Not a call to buy or sell.

Pls dyodd.

Saturday, April 11, 2020

Sasseur Reit

Chart wise, it has a temporary rebound from the low of 53 cents to close higher at 62 cents, looks quite positive!

The major resistance is at 65 cents level.

A nice breakout plus high volume that may likely drive the price higher towards 70 then 72.5 cents with extension to 80 cents level.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.83% based on current price of 62 cents.

Not a call to buy or sell.

Pls dyodd.

The major resistance is at 65 cents level.

A nice breakout plus high volume that may likely drive the price higher towards 70 then 72.5 cents with extension to 80 cents level.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.83% based on current price of 62 cents.

Not a call to buy or sell.

Pls dyodd.

DBS Group

Chart wise, there is no clear indication of a reversal patterns yet!

Will it continues to rise further to move up to test $20 or freezer off and go down to retest $17.90 again! We will know the answer for the coming week.

I think market is still clouded with many uncertainty like fighting to contain the virus, economy may slip into recession etc.

Short term wise, there is no clear sign of market bottoming yet as the recent rebound is just the usual reaction after a drastic selling down effect.

I think is ok to stay sideline !

Stay safe and please take care!

Pls dyodd.

Will it continues to rise further to move up to test $20 or freezer off and go down to retest $17.90 again! We will know the answer for the coming week.

I think market is still clouded with many uncertainty like fighting to contain the virus, economy may slip into recession etc.

Short term wise, there is no clear sign of market bottoming yet as the recent rebound is just the usual reaction after a drastic selling down effect.

I think is ok to stay sideline !

Stay safe and please take care!

Pls dyodd.

Friday, April 10, 2020

OCBC Bank

Chart wise, looks bearish!

It has managed to bounce off from the low of $7.80 and rises higher to close higher at $8.95,looks rather positive.

This is basically a temporary rebound. Will it go lower again after the momentum freezer off.

For investor, some might have already accumulating as the price has managed to cross over the 20MA line, looks pretty interesting.

NAV $10.39

EPS $1.10.

Dividend of 53 cents.

I think dividend is sustainable as the current EPS is almost more than 2 times of the dividend payout. Let's say EPS came down another 20% to 88 cents due to current dismay market condition dividend payout seems not an

Yield is about 5.9% based on the closing price of $8.95,looks pretty attractive.

Those that has managed to scoop it at $7.80 during the low on 23rd March would have been sitting a nice profit.

Immediate resistance is at $9.07.

Breaking out with ease plus good volume that may likely see the price rises higher towards $9.50 with extension to $9.90.

Not a call to buy or sell.

Pls dyodd.

It has managed to bounce off from the low of $7.80 and rises higher to close higher at $8.95,looks rather positive.

This is basically a temporary rebound. Will it go lower again after the momentum freezer off.

For investor, some might have already accumulating as the price has managed to cross over the 20MA line, looks pretty interesting.

NAV $10.39

EPS $1.10.

Dividend of 53 cents.

I think dividend is sustainable as the current EPS is almost more than 2 times of the dividend payout. Let's say EPS came down another 20% to 88 cents due to current dismay market condition dividend payout seems not an

Yield is about 5.9% based on the closing price of $8.95,looks pretty attractive.

Those that has managed to scoop it at $7.80 during the low on 23rd March would have been sitting a nice profit.

Immediate resistance is at $9.07.

Breaking out with ease plus good volume that may likely see the price rises higher towards $9.50 with extension to $9.90.

Not a call to buy or sell.

Pls dyodd.

Thursday, April 9, 2020

Ascendas iTrust

Chart wise, looks bearish!

Likely to continue to trend lower!

The current price of $1.18 is trading below its SMA lines and seems rather weak.

NAV $1.08.

DPU 6.6 cents.

Yield 5.6%.

Short term wise, I think it may go down to retest 98 cents again.

Breaking down of 98 cents plus high volume that may likely see the price sliding down towards 90 then 78 cents.

Not a call to buy or sell.

Pls dyodd.

Likely to continue to trend lower!

The current price of $1.18 is trading below its SMA lines and seems rather weak.

NAV $1.08.

DPU 6.6 cents.

Yield 5.6%.

Short term wise, I think it may go down to retest 98 cents again.

Breaking down of 98 cents plus high volume that may likely see the price sliding down towards 90 then 78 cents.

Not a call to buy or sell.

Pls dyodd.

MAple Comm Trust

High chance of retesting $1.46 again!

Broken down of $1.46 + High volume that may likely see the price going down to test $1.30 then $1.20.

Pls dyodd.

Chart wise, looks bearish!

The same candlesticks chart patterns might replay itself again!

I think is good to be cautious and wait for market confirmation!

Short term wise, high possibility that it may go down again to revisit 1.46 after this temporary rebound.

Not a call to buy or sell.

Pls dyodd.

Broken down of $1.46 + High volume that may likely see the price going down to test $1.30 then $1.20.

Pls dyodd.

Chart wise, looks bearish!

The same candlesticks chart patterns might replay itself again!

I think is good to be cautious and wait for market confirmation!

Short term wise, high possibility that it may go down again to revisit 1.46 after this temporary rebound.

Not a call to buy or sell.

Pls dyodd.

Olam Intl

Chart wise, looks bearish!

It has been sold down from $1.88 to a low of $1.26 before bouncing off to close slightly higher at $1.44, looks rather interesting!

NAV of $1.686

Dividend of 8 cents.

Yield of 5.55%.

The current price remain weak but lately has been seeing insiders buying up from $1.35 to $1.50 level ,looks like current price of $1.44 may be viewed as undervalued.

Short term wise, I think of it is able to cross over $1.53 the recent high smoothly plus good volume that may likely see further upwards move towards$1.60 them $1.70.

Not a call to buy or sell.

Pls dyodd.

It has been sold down from $1.88 to a low of $1.26 before bouncing off to close slightly higher at $1.44, looks rather interesting!

NAV of $1.686

Dividend of 8 cents.

Yield of 5.55%.

The current price remain weak but lately has been seeing insiders buying up from $1.35 to $1.50 level ,looks like current price of $1.44 may be viewed as undervalued.

Short term wise, I think of it is able to cross over $1.53 the recent high smoothly plus good volume that may likely see further upwards move towards$1.60 them $1.70.

Not a call to buy or sell.

Pls dyodd.

Wednesday, April 8, 2020

Accordia Golf tr

Chart wise, looks bullish!

A nice white soldier spotted today plus price Is up 4 cents to 57 cents looks rather positive!

It might be something is brewing !

Short term wise, I think it may move up to test 60 cents.

Breaking out of 60 cents + good volume that may likely drive the price higher towards 66 cents then 70 cents.

Not a call to buy or sell.

Pls dyodd.

A nice white soldier spotted today plus price Is up 4 cents to 57 cents looks rather positive!

It might be something is brewing !

Short term wise, I think it may move up to test 60 cents.

Breaking out of 60 cents + good volume that may likely drive the price higher towards 66 cents then 70 cents.

Not a call to buy or sell.

Pls dyodd.

MapleTree Comm Tr

Chart wise, looks bearish!

The same candlesticks chart patterns might replay itself again!

I think is good to be cautious and wait for market confirmation!

Short term wise, high possibility that it may go down again to revisit 1.46 after this temporary rebound.

Not a call to buy or sell.

Pls dyodd.

The same candlesticks chart patterns might replay itself again!

I think is good to be cautious and wait for market confirmation!

Short term wise, high possibility that it may go down again to revisit 1.46 after this temporary rebound.

Not a call to buy or sell.

Pls dyodd.

Genting Sing

Chart wise, looks bullish!

Likely to continue to trend higher!

The current price of 74.5 cents is staying above its SMA lines + RSI is also rising up nicely likely to see further upwards move!

Short term wise, I think it my move up to retest 75.5 then 80 with extension to 85 cents.

Not a call to buy or sell.

Pls dyodd.

Likely to continue to trend higher!

The current price of 74.5 cents is staying above its SMA lines + RSI is also rising up nicely likely to see further upwards move!

Short term wise, I think it my move up to retest 75.5 then 80 with extension to 85 cents.

Not a call to buy or sell.

Pls dyodd.

Tuesday, April 7, 2020

Frasers L&I trust

It seems the rebound is still holding up well!

It might move up to retest 95 cents then 1.00.

Not a call to buy or sell.

Pls dyodd.

TA wise, looks bearish! Likely to go down again after this temporary rebound!

What is the merger price going to be as the current price is 85.5 cents and definitely is not going to be $1.24 indicated previously!

Yield seem looking attractive but not sure will dpu get lower as economy is badly affected by current situation.

Will it go down to retest the pivot low of 67 cents again!

Not a call to buy or sell. Pls dyodd.

It might move up to retest 95 cents then 1.00.

Not a call to buy or sell.

Pls dyodd.

TA wise, looks bearish! Likely to go down again after this temporary rebound!

What is the merger price going to be as the current price is 85.5 cents and definitely is not going to be $1.24 indicated previously!

Yield seem looking attractive but not sure will dpu get lower as economy is badly affected by current situation.

Will it go down to retest the pivot low of 67 cents again!

Not a call to buy or sell. Pls dyodd.

Subscribe to:

Posts (Atom)