Valuetronics - 30th April 2017

Valuetronics had a very nice and beautiful white thrust bar indicated on the chart on 25th April 2017.

It has also managed to conquer the previous high of 79.5 and closed well at 83 cents. Couple with super high volume, this is rather bullish.

Currently, it is having a breather after this good running up. Is a positive sign that it may continue to trend higher.

This is yet another Setup being indicated on the EBook .

Short term wise, I think it may likely move up to re-conquer the recent high of 84.5. Breaking out of 84.5 with ease + good volume that may propel to drive the share price higher towards 90 cents then 95 cents with extension to $1.00.

( trade base on your own decision)

https://spore-share.com or sporeshare.blogspot.com It is very important to equip and educate ourselves with the Trading or investing knowledge. Don’t rely on tips! Ensure we have a proper plan in place whenever we enter a trade. Don’t speculate and trade without knowing what you are trying to achieve. Only trade when the trading opportunity arise. All information provided is just just for sharing. (Trade/Invest base on your own decision!)

Sunday, April 30, 2017

Genting Sing

Genting Sing - Update 4th May 2017

Is still on track after XD on 4th May 2017. Looking good to resume this uptrend mode.

Genting Sing - 30th April 2017

Genting Sing had a very nice breaking out of 1.09 on 26th April 2017 and closed well at 1.115. Couple with high volume , this is rather bullish.

This upwards momentum was followed-through with another positive white candlestick the next day and touching the high of 1.14 on 27th April. Looking good for it to continue to trend higher.

The is one of the setup being indicated on the EBook.

Currently, it is taking a break ( 1.115) and may likely continue to move up to re-capture 1.14 and trend higher.

Short term wise, I think a nice breaking out of 1.14 with ease + good volume that may propel to drive the share price higher towards 1.20 then 1.25 with extension to 1.30.

( trade base on your own decision)

Is still on track after XD on 4th May 2017. Looking good to resume this uptrend mode.

Genting Sing - 30th April 2017

Genting Sing had a very nice breaking out of 1.09 on 26th April 2017 and closed well at 1.115. Couple with high volume , this is rather bullish.

This upwards momentum was followed-through with another positive white candlestick the next day and touching the high of 1.14 on 27th April. Looking good for it to continue to trend higher.

The is one of the setup being indicated on the EBook.

Currently, it is taking a break ( 1.115) and may likely continue to move up to re-capture 1.14 and trend higher.

Short term wise, I think a nice breaking out of 1.14 with ease + good volume that may propel to drive the share price higher towards 1.20 then 1.25 with extension to 1.30.

( trade base on your own decision)

Thursday, April 27, 2017

Federal Int

Federal Int - 27th April 2017

Federal Int after hitting the low of 24 cents on 6th Feb 2017, it has since managed to stage a nice recovery and head higher to conquer 30 cents on 13th Mar. This is generally rather bullish.

It has continue to trend higher from 30 cents to touch a new high at 48.5/49 cents On 25th April.Couple with high volume, this is rather positive.

Short term wise, I think it may likely move up to retest 49 / 50 cents. Breaking out of 50 cents with ease , it may likely propel to drive the share price higher towards 55 then 60 cents.

( trade base on your own decision).

Federal Int after hitting the low of 24 cents on 6th Feb 2017, it has since managed to stage a nice recovery and head higher to conquer 30 cents on 13th Mar. This is generally rather bullish.

It has continue to trend higher from 30 cents to touch a new high at 48.5/49 cents On 25th April.Couple with high volume, this is rather positive.

Short term wise, I think it may likely move up to retest 49 / 50 cents. Breaking out of 50 cents with ease , it may likely propel to drive the share price higher towards 55 then 60 cents.

( trade base on your own decision).

Thursday, April 13, 2017

HEETON

HEETON - 13rd April 2017

Heeton had a very nice and beautiful white thrust bar appeared on the chart on 12th April 2017. Couple with super high volume and closed well at 54.5 cents , this is rather bullish.

We would like to seize the advantage of this thrust bar and likely to see this momentum continue to drive the share price higher.

Short term wise it may likely re-conquer 55 cents and head higher to test 60 then 61 cents.

Crossing over of 61 cents with ease that may propel to drive the share price higher towards 70 with extension to 75 cents.

( trade base on your own decision)

Heeton had a very nice and beautiful white thrust bar appeared on the chart on 12th April 2017. Couple with super high volume and closed well at 54.5 cents , this is rather bullish.

We would like to seize the advantage of this thrust bar and likely to see this momentum continue to drive the share price higher.

Short term wise it may likely re-conquer 55 cents and head higher to test 60 then 61 cents.

Crossing over of 61 cents with ease that may propel to drive the share price higher towards 70 with extension to 75 cents.

( trade base on your own decision)

Friday, April 7, 2017

GUOCOLAND

Guocoland (F17)

Guocoland from TA point of view is in a neutral mode direction.

Immediate support is at $1.825 and resistance is at $1.89.

The recent purchase by the company director - Mr.Quek on 22nd,24th & 28the Feb 2017 at an average price of $1.845 in my opinion is being viewed as a undervalued price.

I think it might be a good opportunity for its true value for the price to be appreciated in time to come.

NAV of $2.958, P/B is 0.622 .

For every 62 cents you pay for the share price you are getting a $1.00 value.

At a glance of the past financial results:

Short Term wise, I think it may likely move up to test $1.89.

Crossing over of $1.89 with ease that may likely propel to drive the share price higher towards $1.95 then $2.00/$2.02.

( Trade base on your own decision)

Guocoland from TA point of view is in a neutral mode direction.

Immediate support is at $1.825 and resistance is at $1.89.

The recent purchase by the company director - Mr.Quek on 22nd,24th & 28the Feb 2017 at an average price of $1.845 in my opinion is being viewed as a undervalued price.

I think it might be a good opportunity for its true value for the price to be appreciated in time to come.

NAV of $2.958, P/B is 0.622 .

For every 62 cents you pay for the share price you are getting a $1.00 value.

At a glance of the past financial results:

Short Term wise, I think it may likely move up to test $1.89.

Crossing over of $1.89 with ease that may likely propel to drive the share price higher towards $1.95 then $2.00/$2.02.

( Trade base on your own decision)

Thursday, April 6, 2017

ThaiBev

$ThaiBev(Y92)

A nice run away Gapped Up on 15 Feb 2017 and closed well at 94 cents , this is rather bullish. Presently it is in a neutral mode and may likely move up to re-attemp 97 cents. Crossing over with ease may likely test $1.00 and above.

A nice run away Gapped Up on 15 Feb 2017 and closed well at 94 cents , this is rather bullish. Presently it is in a neutral mode and may likely move up to re-attemp 97 cents. Crossing over with ease may likely test $1.00 and above.

Saturday, April 1, 2017

What would be the Cut Loss/Stop Loss Price for Long/Buy trade

What would be the Cut Loss/Stop Loss Price for Long/Buy trade - 2nd April 2017

Taking for example for using this counter Singpost .

Purchased price @ $1.365 for 10000 share.

Total amount purchased is $13650 ( excluding brokerage fee etc)

Cut Loss /Stop Loss price depends on your risk profile.

Let say about 5% Cut Loss/Stop Loss price .

We would be looking at the Cut Loss/Stop Loss price at $1.30.

$1.365 less $1.30 = $$0.065 x 10000 share = $650.

$650 divided by $13650 = 4.76%

In this case , your Cut loss amount will be $650 which is approximately close to 5% that you could afford to loss.

Other may have a higher risk appetite and can roughly use 8% Cut Loss as a way to limit your loss.

For 8%, the Cut Loss price will be at $1.255 .

$1.365 less $1.255 = $0.11 x 10000 share = $1100.

$1100 divided by $13650 = 8.05%.

( Trade base on your own decision)

Taking for example for using this counter Singpost .

Purchased price @ $1.365 for 10000 share.

Total amount purchased is $13650 ( excluding brokerage fee etc)

Cut Loss /Stop Loss price depends on your risk profile.

Let say about 5% Cut Loss/Stop Loss price .

We would be looking at the Cut Loss/Stop Loss price at $1.30.

$1.365 less $1.30 = $$0.065 x 10000 share = $650.

$650 divided by $13650 = 4.76%

In this case , your Cut loss amount will be $650 which is approximately close to 5% that you could afford to loss.

Other may have a higher risk appetite and can roughly use 8% Cut Loss as a way to limit your loss.

For 8%, the Cut Loss price will be at $1.255 .

$1.365 less $1.255 = $0.11 x 10000 share = $1100.

$1100 divided by $13650 = 8.05%.

( Trade base on your own decision)

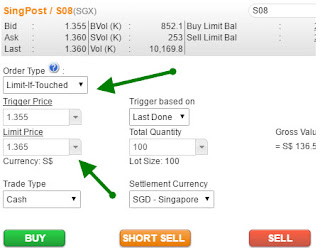

Trading Tools for Long/Buy trade using normal brokerage account

Trading Tools for Long/Buy trade - 2nd April 2017

I personally think this kind of trading tools feature is ideal for those who are using the normal brokerage account as opine to the usual CFD feature.

Not many local brokerage securities is offering this kind of feature.

I think Phillip securities and CIMB trading platform may have this kind of feature to utilize the Long/Buy "Limit-If-Touched" options.

For a trader that would like to set a certain price to buy in this counter - SingPost for example.

He /She may set the limit price to Buy in let say $1.365 for 10000 share.

If the price does not hit $1.365 and above, the limit price will not be executed.

( Trade base on your own decision)

I personally think this kind of trading tools feature is ideal for those who are using the normal brokerage account as opine to the usual CFD feature.

Not many local brokerage securities is offering this kind of feature.

I think Phillip securities and CIMB trading platform may have this kind of feature to utilize the Long/Buy "Limit-If-Touched" options.

For a trader that would like to set a certain price to buy in this counter - SingPost for example.

He /She may set the limit price to Buy in let say $1.365 for 10000 share.

If the price does not hit $1.365 and above, the limit price will not be executed.

( Trade base on your own decision)

Subscribe to:

Posts (Atom)