Daiwa Hse Log - She is moving up slowly and looking quite good to hit 65.5 cents. A nice breakout would likely see her rising up towards 71 cents!

Indeed, she has managed to reclaim 62.5 cents, fantastic!

Last Friday closed well at 64.5 cents looks rather positive and she may likely rise up towards 71 cents!

Pls dyodd.

Finally, she is back to 62 cents.

Chart wise, shw is gaining momentum and likely continue to rise higher to reclaim 62.5 than 65.5 with extension to 71 cents.

Pls dyodd.

Chart wise, bullish mode!

Let's see if she can cross over 60 cents smoothly in order rise higher towards 62.5 than 65.5 cents.

IPO was 80 cents in 26 Nov 2021.

Pls dyodd.

She is gaining momentum!

Likely to cross over 57 cents and rises higher towards 59-60 cents and above!

Pls dyodd.

Chart wise, bullish mode!

Short term wise, I think she is rising up to test 59 cents than 62.5 cents!

Yearly dividend is of about 5.2 cents.

Yield is 9.12%.

Occupancy rate 100%.

Gearing below 40%.

Dpu likely increase!

Pls dyodd.

Finally, we have witnessed the whole reit sector is in the green today! This is probably due to the cpi data from US which was reported better than expected at 3.2%.

Overall good news for the market!

Hopefully, Bank can drop more than we can see opportunity coming back!

Pls dyodd.

Daiwa Hse Log Trust - A rare Logistics Trust in Japanese.

I think is a gems which is quite highly under-rated with yield of more than 9%, stable dpu of 5.2 cents , gearing below 40% plus long WALE!

I think is a gd pivot point!

At 53.5 cents, yield is 9.7%.

Chart wise, it has managed to bounce-off from 50 cents and closed well at 53.5 cents looks rather bullish!

Short term wise, I think likely to rise up to test 56 cents than 59.5 cents.

Pls dyodd.

Daiwa Hse Log Tr - 3rd quarter results is out!

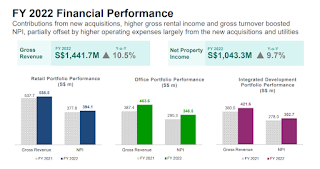

Gross Revenue is up 4.8% and NPI is up 3.9%. Distribution income is up 2.2% to SGD 27m.

100 percent occupancy, low gearing, I think the results is good!

Estimating yearly dpu of 5.2 cents, yield is 10% at current price of 52 cents.

Pls dyodd.