Chart wise, bearish mode!

She is hovering at the support level of 1.90, looks rather interesting!

Next support is at 1.86.

Please dyodd.

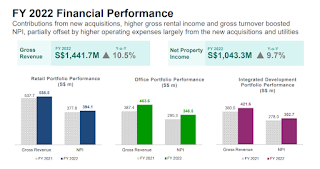

Hosey! Results is out! NPI is up 10.1% to 552m.

Distribution income increase 1.7% to 353.2m.

Dpu increase 1.5% YOY to 5.3 cents.

Occupancy rate 96.7%.

Gearing 40.4%.

WALE of 3.6 years.

I think the results is OK!

XD 8th of August. Pay date 15 September.

Today closed well at 2.00 high probability she will rise up to reclaim 2.03 then 2.08 with extension to 2.18.

Not a call to buy or sell!

Please dyodd.

Yesterday closed well at 1.92, let's see will she continue to rise up to reclaim 1.95 then 2.00-2.03.

Results will be out on 1st Aug 2023!

Dividend is coming!

Chart wise, bearish mode!

Likely to see further weakness!

She has further weaken and closed lower at 1.86 looks like she may go further down to test the recent support at 1.82 then 1.80 with extension to 1.74.

Yield is about 5.7% at 1.86.

NAV 2.116.

Pls dyodd.

I have added a bit at 1.91 as it has managed to bounced off from 1.89.

At 1.91, yield is about 5.55% of which I think is quite a gd yield for this giant retail cum grade A office reit.

Not a call to buy or sell!

Pls dyodd.

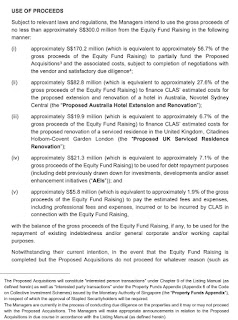

CapitaLand Integrated Commercial Trust (CICT or the Trust) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST) with a market capitalisation of S$13.5 billion as at 31 December 2022. It debuted on SGX-ST as CapitaLand Mall Trust in July 2002 and was renamed CICT in November 2020 following the merger with CapitaLand Commercial Trust (CCT).

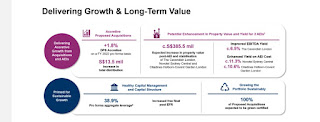

Looking at the FY 2022 results the NPI is up 9.7% and achieved an increased of DPU from 10.40 to 10.58 cents. It looks like the rental income is improving!

The First Quarter 2023 update is as follow:The NPI is up 11.3% to 276.3m and occupancy rate % has improved from 95.8 to 96.2.

The gearing is slightly from 40.90 to 40.40%.

The Average WALE is 3.7 years.

The Top 10 tenants are RC Hotels (Pte) Ltd, WeWork Singapore, GIC Private Limited, NTUC Enterprise Co-Operative Ltd & Temasek Holdings etc.

Total Property value is about 24.2 billion of which is the Biggest reit counter listed on the Local Singapore Exchange.

NAV is about 2.116.

Yearly dividend of about 10.58, Yield is about 5.6%(based on current price of 1.89).

I think gd pivot entry point is back!

Please dyodd.