I shall wait for 1.63 to re-enter again after letting go at 1.74.

The support is at 1.61 - 1.63 , let's see if it come back again!

At 1.63, yield is about 5.55%.

Not a call to buy or sell!

Please dyodd.

Closed at 1.64 after went ex.dividend looks like gd price is back!

At 1.64 , yield is about 5.5% which is quite a gd yield level for this blue chips index reit.

Chart wise, A nice pivot point is at 1.60 - 1.63.

Not a call to buy or sell!

Please dyodd.

XD 1st August, 2.037 cents dividend.

Price is down 3 cents to 1.70.

I think profit taking before going Xd.

Heng ah, I have locked in kopi money this morning at 1.74.

Pls dyodd.

Distribution income increased 3.1% to 112m.

Dpu increased 0.1% to 2.271 cents.

Occupancy rate 97.1%.

4.1 % rental reversions.

I think the results is not bad at least dpu is still up a little bit.

The power of CD!

She is gaining strength and likely rise up to reclaim 1.75.

Indeed, she has managed to reclaim 1.67 and rises higher to touch 1.71 looks rather bullish!

Likely to rise up further to test 1.75 and above.

Please dyodd.

Mapletree Logistics Trust (“MLT”) is Singapore’s first Asia-focused logistics real estate investment trust. Listed on the Singapore Exchange Securities Trading Limited in 2005, MLT invests in a diversified portfolio of quality, well-located, income producing logistics real estate in Singapore, Hong Kong SAR, Japan, China, Australia, South Korea, Malaysia, Vietnam and India.

The Manager, Mapletree Logistics Trust Management Ltd., is committed to providing Unitholders with competitive

total returns through the following strategies:

- optimising organic growth and hence, property yield from the existing portfolio;

- making yield accretive acquisitions of good quality logistics properties; and

- managing capital to maintain MLT’s strong balance sheet and provide financial flexibility for growth.

Our properties, built to modern building specifications, are strategically located near to major expressways and established logistics clusters in nine geographic markets across Asia Pacific.

The Manager, Mapletree Logistics Trust Management Ltd., is committed to providing Unitholders with competitive total returns through the following strategies:

- optimising organic growth and hence, property yield from the existing portfolio;

- making yield accretive acquisitions of good quality logistics properties; and

- managing capital to maintain MLT’s strong balance sheet and provide financial flexibility for growth.

Our Vision

To be the preferred real estate partner of choice to customers requiring high quality logistics and distribution spaces in Asia-Pacific.

Our Mission

To provide Unitholders with competitive total returns through regular distributions and growth in asset value.

As a REIT established in Singapore, MLT is constituted by the Trust Deed. A copy of the Trust Deed can be inspected at the registered office of the Manager,which is located at 10 Pasir Panjang Road, #13-01 Mapletree Business City, Singapore 117438, subject to prior appointment.

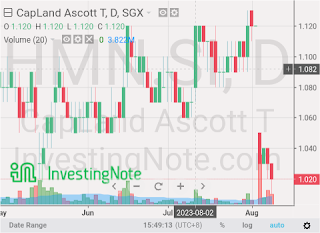

TA wise, she is still quite weak!

Need to reclaim 1.67 in order to reverse this

downtrend and rises higher!

Yearly dpu of 9 cents, yield is 5.5% of which I think is quite good!

Gearing is below 40%. Market cap is about 8.225b.

Please dyodd.

She is rising up to test 1.67 soon. Now trading at 1.65 to 1.66 as of 12th July 1.12pm. Awesome!