Food Empire - Today another extension green bar but the volume is not high. I think likely to pull back anytime!

I think is gd to lock in profit!

Pls dyodd.

2nd March 2025:

Food Empire - TA wise, bullish mode. She is rising up to test 1.20 than 1.27 to 1.30. Huat ah!

Pls dyodd.

28th February 2025:

Food Empire - Chart wise, bullish mode. Likely to clear 1.16 and rises higher towards 120 level.

Pls dyodd.

26th February 2025:

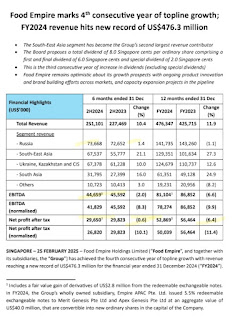

Food Empire - FY results is out. 2nd Half total Revenue is up 10.4 percent to 251m, Net profit is down 0.6 percent to 29.65m. Final dividend increased to 6 cents plus special dividend of 2 cents, exceeded my expectations.

FY total Revenue is up 11.9% to 476m.

Net Profit is down 6.4% to 52.86m which is higher than analysts expectations of 47m.

The growth momentum likely continue in 2025.

XD 2nd May. Pay date 14 May.