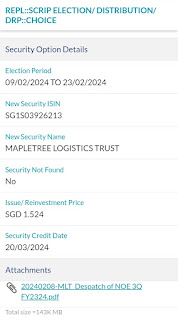

Just received the letter for tye scrip offered at 1.524 per share.

I have nibbled a bit at 1.51 today!

Most probably I will skip and take cash instead!

Last day to submit is on 23rd Feb 5pm.

Do take note!

At 1.51, yield is about 6%. I think is a great yield level for me.

Mapletree Log Tr - Scrip price offered is 1.524, which is higher than current market price of 1.51! Does it make sense to go for scrip! O would rather take cash and buy straight from market directly which is slightly cheaper.

Election period is from 9th Feb to 23 Feb.

New share will be credited on 20th March.

At 1.51, Yield is about 6% for this index reit of which I think is a no-brainer opportunity!

Pls dyodd.

Mapletree Log Tr - Yesterday queueing to get some at 1.60 but didnt managed to get! At 1.61, yield is nice at 5.64%! Will try again on Monday!

Pls dyodd.

Results will be out on 24th Jan after trading hours. Dividend is coming, great!

Yield is about 5.5% at 1.63. I think is much better than kdc.

Pls dyodd.

Wah, gd news:

Mapletree Logistics Trust*

— Deepens Presence in India with Latest Acquisition of a newly completed modern Grade A warehouse with high quality building specifications

— 100% leased to a leading domestic 3PL operator with long lease of 8 years.

Mapletree Log Tr (MLT) - Wah, today closed at 1.62 looks like Bull is in control! A nice crossing over of 1.62 smoothly we may likely see her rising up higher to test 1.73. Huat ah!

CpI data will be released on 12th Dec.

If the numbers are within expectations then it may bring cheers to the stocks market!

Pls dyodd.

Chart wise, bullish mode!

Short term wise, I think likely to rise to test 1.62!

A nice breakout accompanied with good volume would likely see her rising up to test 1.70 to 1.73.

Pls dyodd.

One of the great opportunity from applying scrip using dividend to increase your no. Of share plus keep generating future dividend! You can also book an instant gain from the price difference of 1.58 less 1.437 !

Do remember last day to submit is 5PM 23rd November 2023.

I have mailed out ! Swee!

Today Ex.dividend of 2.268 cents. Nice quarterly dividend payout, Fantastic!

Chart wise, it has managed to bounce-off from 1.45 and closed higher at 1.49 looks rather interesting!

With rate hike most probably paused in November we may see some pressure taking off from reit financing cost and hopefully this might help to support the price at the current level!

I see great pivot point at current price level!

At 1.49, yield is about 6.05%.

Pls dyodd.

Half year results is out!

A beautiful sets of financial numbers that beat my expectations of dpu of 2.25 cents !

Gross Revenue is up 15% to 186.7m.

Dividend of 2.268 cents , XD 31 October.

I think is a gd sets of results!

Huat ah!

Pls dyodd.

At 1.45, estimating yearly dpu of 9.02 cents, yield is 6.22% I think great price is back!

NAV is 1.416.

I think good pivot point to watch will be at 1.41 which was the recent low!

Pls dyodd.

Nibbled a bit at 1.60!

Results is due on 24th October, estimating dpu of 2.26 cents.

Yield is about 5.63% estimating yearly dividend of 9.02 cents.

Pls dyodd.

I think sales is still on!

This is one of the giant index logistics reit that has been expanding their assets and consistently increasing the dpu!

Please dyodd.

Closed at 1.64 after went ex.dividend looks like gd price is back!

At 1.64 , yield is about 5.5% which is quite a gd yield level for this blue chips index reit.

Chart wise, A nice pivot point is at 1.60 - 1.63.

Not a call to buy or sell!

Please dyodd.

XD 1st August, 2.037 cents dividend.

Price is down 3 cents to 1.70.

I think profit taking before going Xd.

Heng ah, I have locked in kopi money this morning at 1.74.

Pls dyodd.

Distribution income increased 3.1% to 112m.

Dpu increased 0.1% to 2.271 cents.

Occupancy rate 97.1%.

4.1 % rental reversions.

I think the results is not bad at least dpu is still up a little bit.

The power of CD!

She is gaining strength and likely rise up to reclaim 1.75.

Indeed, she has managed to reclaim 1.67 and rises higher to touch 1.71 looks rather bullish!

Likely to rise up further to test 1.75 and above.

Please dyodd.

Mapletree Logistics Trust (“MLT”) is Singapore’s first Asia-focused logistics real estate investment trust. Listed on the Singapore Exchange Securities Trading Limited in 2005, MLT invests in a diversified portfolio of quality, well-located, income producing logistics real estate in Singapore, Hong Kong SAR, Japan, China, Australia, South Korea, Malaysia, Vietnam and India.

The Manager, Mapletree Logistics Trust Management Ltd., is committed to providing Unitholders with competitive

total returns through the following strategies:

- optimising organic growth and hence, property yield from the existing portfolio;

- making yield accretive acquisitions of good quality logistics properties; and

- managing capital to maintain MLT’s strong balance sheet and provide financial flexibility for growth.

Our properties, built to modern building specifications, are strategically located near to major expressways and established logistics clusters in nine geographic markets across Asia Pacific.

The Manager, Mapletree Logistics Trust Management Ltd., is committed to providing Unitholders with competitive total returns through the following strategies:

- optimising organic growth and hence, property yield from the existing portfolio;

- making yield accretive acquisitions of good quality logistics properties; and

- managing capital to maintain MLT’s strong balance sheet and provide financial flexibility for growth.

Our Vision

To be the preferred real estate partner of choice to customers requiring high quality logistics and distribution spaces in Asia-Pacific.

Our Mission

To provide Unitholders with competitive total returns through regular distributions and growth in asset value.

As a REIT established in Singapore, MLT is constituted by the Trust Deed. A copy of the Trust Deed can be inspected at the registered office of the Manager,which is located at 10 Pasir Panjang Road, #13-01 Mapletree Business City, Singapore 117438, subject to prior appointment.

TA wise, she is still quite weak!

Need to reclaim 1.67 in order to reverse this

downtrend and rises higher!

Yearly dpu of 9 cents, yield is 5.5% of which I think is quite good!

Gearing is below 40%. Market cap is about 8.225b.

Please dyodd.

She is rising up to test 1.67 soon. Now trading at 1.65 to 1.66 as of 12th July 1.12pm. Awesome!