Hosey! A nice Gap up this morning accompanied with good volume and is now trdat 3.12 to 3.13 looks rather bullish and may likely continue to trend higher to test 3.20 to 3.24!

A nice breakout of 3.24 would signifying the strong momentum will drive the price higher towards 3.40 than 3.49.

Pls dyodd.

Wah, nice rebound from 2.91 and rises up to close well at 3.13. Coupled with high volume this is rather bullish!

2 white soldiers spotted on the chart looks like a 3rd white soldier may follow through!

Chart wise, I think likely to rise up to test 3.20 than 3.24. A nice breakout of 3.24 plus high volume we may likely see her rising up to test 3.30 than 3.45.

Pls dyodd.

A nice green bar spotted on the chart after the series of selling down looks rather interesting!

I think a rebound may likely happen!

At 2.91, let's says yearly dividend is 12 cents / 15 cents yield is about 4.15% and 5.15%.

The recurring fees from the list of reits counter they're managing under CapitaLand would certainly a plus point to sustain their revenue and dividend payout!

With US indexes closed positively - Dow +500 points, Nasdaq 100+ points likely to see sti mirroring the US indexes.

November rate hike most probably might be paused I think this might bode well for the market.

I think gd pivot point is here!

Pls dyodd.

Chart wise, bearish mode! She has gone down to touch 2.92 this morning, looks like gd pice is here!

At 2.92 yield is about 4.11%.

NAV 2.84.

The comp has been actively buying back share.

Yesterday they have bought back 4m share at 3.03.

Not a call to buy or sell.

I think good opportunity is back!

At 3.03, yield is about 3.96%. Immediate support is at 3.00-2.98. She has managed to stay above the recent low of 3.02. If 3.00 cannot hold then we may see her going down to test 2.95 than 2.85.

Not a call to buy or sell!

Please dyodd.

Pls dyodd.

CapitaLand Investment - Results is out, not bad! Total Revenue is down 1% to 1345m, Operating PATMI is dien 1% to 344m, recurring FM fee grow by 10% to 183m, awesome!

I think Results is not bad and Operating profit is quite stable!

I think yearly dividend of 12 cents is sustainable and may be see further increase if FM fee grow faster than expected!

I have nibbled small unit at 3.26 yesterday during the closing!

Aiming for some kopi money!

At 3.26, the yield is about 3.65% if the yearly dividend is 12 cents.

She is due to report her 1st half results on 11th August that may provide us the clue how is the direction of the share price!

Not a call to buy or sell!

Please dyodd.

Let's monitor and wait for her to dip a bit to 3.22-3.26 and see if it can cross the resistance at 3.28 smoothly before taking further action !

At 3.29, yield is 3.6%.

Not a call to buy or sell!

Please dyodd.

Chart wise, bearish mode!

Likely to continue to trend lower!

Short term wise, I think she may go down to test 3.20.

Breaking down of 3.20 plus high volume she may continue to slide further down to 3.00 then 2.94.

Yearly dividend is 12 cents. Yield is about 3.72% at 3.22.

Please dyodd.

"CapitaLand Investment remains steadfast in being a trusted partner as we strengthen our position as a leading global real estate investment manager which delivers high quality returns."

CLI’s investment management leadership in Asia began about two decades ago, when we listed Singapore’s first real estate investment trust (REIT), CapitaLand Mall Trust. Today, our six listed funds across Singapore and Malaysia hold a Funds under Management (FUM) of approximately S$60 billion.

And that’s only part of the real estate portfolio that we’ve built — over S$29 billion FUM are also managed through a comprehensive and expanding private funds platform comprising more than 30 private vehicles.

Including assets held directly by CLI as well as assets managed through our global lodging platform, CLI oversees S$133 billion in Real Estate Assets Under Management (RE AUM).

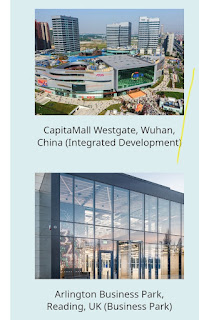

In addition to Singapore, CLI’s core markets include China and India. But our boots on the ground extend far beyond that, to markets across Asia Pacific, Europe, and the USA. Our real estate and management expertise has helped us amass a diversified portfolio of recognisable brands, operating platforms, and asset classes which include retail, office, lodging, business parks, industrial, logistics and data centres.

CapitaLand Investment's (CLI) listed funds business comprises five REITs and business trusts listed on the Singapore Exchange and one on Bursa Malaysia, with a total market capitalisation of S$32.2 billion1. Our listed funds portfolio is focused on driving sustainable distributions and increasing value for our unitholders.

Over time, we have built a strong track record as a Sponsor, making sure our listed funds are always efficiently structured and well-positioned for continued growth.

CapitaLand Investment managed the listed reit companies like Ascendas REIT, CapLand China Trust, CapLand Ibdia Trust, CapitaLand Integrated Commercial Trust and Ascott trust.

CapitaLand Investment (CLI) owns and manages over 1,000 quality properties across the globe, providing a wide range of integrated real estate solutions for work, live and play. The current assets pipeline on CLI's balance sheet provides a diversified stable of high-quality assets with visible monetisation potential.

With a full stack of investment and operating capabilities, we present a unique value proposition for our partners, investors, tenants and customers.