Yesterday, closed lower at 3.65 cents , down 2 cents from 3.67 looks rather negative! I think likely to continue to go lower to test 3.59 Than 3.50.

Pls dyodd.

Wah, she has broken down the support at 3.70.

Trading at 3.67, high probability she may breakdown 3.66 and gi further down to test 3.59 Than 3.50.

Please dyodd.

p> Wah, she is rather weak as the price keep drifting lower to touch 3.72 a moment ago. HIGH probability she may go down to test 3.70 than 3.67 with further sliding down to test 3.50 level.

Please dyodd.

This Wednesday US will be releasing the cpi data. This may set pace for the price to go higher or lower.

< script async="" crossorigin="anonymous" src="https://pagead2.googlesyndication.com/pagead/js/adsbygoogle.js?client=ca-pub-8679583308408160">

Chart wise, bearish mode!

I think likely to go down to test 3.70 than 3.67 with extension to 3.5

Please dyodd.

Yearly dividend is about 14.4 cents.

Yield is about 3.8% at 3.75. Tbills is also giving about the same interest rate and much lower risk. SSB 3.06% also provide another alternative option.

I think she has to go lower in order to attract some bargains hunter. It has to be more than 4% yield in order to see some buying activities..

I think 3.50 might be good pivot point!

Not a call to buy or sell!

Please dyodd.

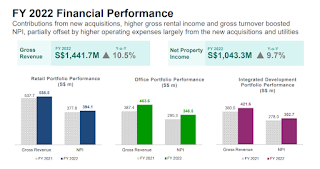

Gross Revenue increase 23.6% to 74.4m, swee!

Net Property Income increased 25% to 70m.

Dpu increase 3.3% to 7.29 cents.

Gearing 35.5%.

I think is a gd sets of financial results!

XD 2nd August. Pay date 30th August.

Yesterday it looks like some buying activities is back to support this beaten down healthcare reit judging from the high volume reflected on the chart. It has manged to bounce off from 3.66 to close well at 3.75 looks rather interesting!

I think is good to wait for market confirmation to see if it can reclaim 3.82 in order to find out if this was a throw-back reaction!

Please dyodd.

She has been sold down 13 cents to close at 3.67, doesn't look good!

The selling down volume is huge! I think is good to let it settle down before making any action!

At 3.67, yield is about 3.95% which is not bad for this healthcare reit counter!

results will be out on 26th July cum dividend.

Please dyodd.

Parkway Life REIT ("PLife REIT") is one of Asia's largest listed healthcare REITs. It invests in income-producing real estate and real estate-related assets used primarily for healthcare and healthcare-related purposes. As at 31 March 2023, PLife REIT's total portfolio size stands at 61 properties totalling approximately S$2.20 billion.

Mission

To deliver regular and stable distributions and achieve long-term growth for our Unitholders.

Our Growth Strategy

PLife REIT is firmly guided by its principle of staying prudent and focused in its growth strategy, focusing on:

As at 31 March 2023, PLife REIT has successfully expanded its total portfolio to 61 properties, including hospitals and medical centres in Singapore, Malaysia and 57 healthcare-related assets in Japan, worth approximately S$2.20 billion1.

Targeted Investment

As PLife REIT continues to be on the lookout for high-quality, yield-accretive acquisition opportunities in the region, it remains discerning and prudent in its approach of acquiring assets that are not only value -generating, but also preserve the long-term defensiveness of the overall portfolio.

Proactive Asset Management

Through proactive asset management, PLife REIT constantly strives to maximise portfolio performance in order to enhance the revenue-generating ability of its properties and ensure sustainable earnings for its Unitholders.

As part of PLife REIT’s initiative to drive organic growth and foster good Landlord-Lessee relationships, it seeks to work closely with its Lessees to understand their operational requirements and embark on Asset Enhancement Initiatives (“AEIs”) which are tailored to suit the needs of its healthcare operators and end users of the properties. Such strategic collaborative arrangements serve to benefit all parties and promote greater revenue sustainability for PLife REIT.

PLife REIT has, leveraging on its clustering/ partnering approach and good landlord-lessee relationships, successfully expanded its nursing home portfolio and completed 14 AEIs in Japan since its maiden entry in 2008 and one at its Malaysia property (Gleneagles Intan Medical Centre Kuala Lumpur).

Moving forward, PLife REIT remains committed to exploring and rolling out more of such AEIs across its entire portfolio to extract the greatest value from its properties. To further strengthen PLife REIT's earnings resiliency, it is also focused on consolidation efforts for its Japan portfolio to optimise operating synergies and achieve greater cost savings.

Capital and Financial Management

PLife REIT aims to maintain a strong financial position through prudent and dynamic capital and financial management, to ensure continuous access to funding at optimal cost, maintain stable distributions to Unitholders and achieve a steady net asset value.

As at 31 March 2023, PLife REIT's gearing was 37.5% which complied with the stipulated Aggregate Leverage limit1. The interest coverage ratio stood at 15.6 times2.

Dynamic liability and liquidity risk management

PLife REIT adopts a dynamic and pro-active approach for its liability and liquidity risk management. Our key liability and funding management strategies in support of our regional growth aspirations are:

1) To achieve diversified funding sources at an optimal cost

Diversify our funding sources from a panel of high quality banks, establishing and maintaining our Debt Issuance Programme and other financing sources to attain varied liability tenure, with the end objective of maintaining the most optimal financing cost mix.

2) To enhance the defensiveness of PLife REIT's Balance Sheet strength

Dynamically manage our debt maturity profile to ensure well-spread debt maturities and at the same time, to maintain an optimal capital structure.

Tactical approaches adopted in view of the above strategies are:

a) Conscientious effort in lengthening and spreading out the debt maturity period;

b) Cultivating and maintaining a panel of key banks to support our long term growth;

c) Establishing alternative source of fund. In this respect, PLife REIT, through its wholly-owned subsidiary, Parkway Life MTN Pte Ltd (the “MTN Issuer”), put in place a S$500 million Multicurrency Debt Issuance Programme to provide PLife REIT with the flexibility to tap various types of capital market products including issuance of perpetual securities when needed. On 6 December 2022, the Group issued a 6-year JPY5.0 billion and a maiden 7-year JPY6.04 billion fixed rate notes to pre-emptively refinance existing fixed rate notes due in 2023 and term out the JPY short-term loans drawn down for acquisition financing. As at 31 March 2023, there were five series of outstanding unsecured fixed rate

notes amounted to JPY19.84 billion3 (approximately S$202.6 million) issued under the Debt Issuance Programme, which diversified PLife REIT’s funding sources.

d) Minimising near-term refinancing risk through pre-emptive terming out current debts. With the new notes issuance, PLife REIT has effectively managed its debt maturity profile with no immediate long-term debt refinancing needs until February 2024.

Financial risk management

PLife REIT adopts prudent financial risk management to manage the exposure to interest rate risk and foreign currency risk. Our policy is to hedge at least 50% (up to 100%) of all financial risks.

Interest rate risk is managed on an ongoing basis with the primary objective of limiting the extent to which net interest expenses could be affected by adverse movements in interest rates, by hedging the long term committed borrowings through the use of interest rate hedging financial instruments. For the foreign exchange ("Forex") risk management, we strive to hedge Forex risk on principal which will allow PLife REIT to maintain a stable net asset value, as the Forex fluctuation on foreign asset will offset the Forex fluctuation of the hedging instrument. We also aim to hedge the Forex risk on net overseas income which will provide PLife REIT with stability in distributable income, as PLife REIT will be shielded from exchange rate fluctuation on foreign income.

As at 31 March 2023, the Group has put in place Japanese Yen forward exchange contracts till 1Q 2027 and about 78% of interest rate exposure is hedged.

Chart wise, bullish

Parkway Life REIT ("PLife REIT") is one of Asia's largest listed healthcare REITs. It invests in income-producing real estate and real estate-related assets used primarily for healthcare and healthcare-related purposes. As at 31 March 2023, PLife REIT's total portfolio size stands at 61 properties totalling approximately S$2.20 billion.

Mission

To deliver regular and stable distributions and achieve long-term growth for our Unitholders.

Our Growth Strategy

PLife REIT is firmly guided by its principle of staying prudent and focused in its growth strategy, focusing on:

As at 31 March 2023, PLife REIT has successfully expanded its total portfolio to 61 properties, including hospitals and medical centres in Singapore, Malaysia and 57 healthcare-related assets in Japan, worth approximately S$2.20 billion1.

Targeted Investment

As PLife REIT continues to be on the lookout for high-quality, yield-accretive acquisition opportunities in the region, it remains discerning and prudent in its approach of acquiring assets that are not only value -generating, but also preserve the long-term defensiveness of the overall portfolio.

Proactive Asset Management

Through proactive asset management, PLife REIT constantly strives to maximise portfolio performance in order to enhance the revenue-generating ability of its properties and ensure sustainable earnings for its Unitholders.

As part of PLife REIT’s initiative to drive organic growth and foster good Landlord-Lessee relationships, it seeks to work closely with its Lessees to understand their operational requirements and embark on Asset Enhancement Initiatives (“AEIs”) which are tailored to suit the needs of its healthcare operators and end users of the properties. Such strategic collaborative arrangements serve to benefit all parties and promote greater revenue sustainability for PLife REIT.

PLife REIT has, leveraging on its clustering/ partnering approach and good landlord-lessee relationships, successfully expanded its nursing home portfolio and completed 14 AEIs in Japan since its maiden entry in 2008 and one at its Malaysia property (Gleneagles Intan Medical Centre Kuala Lumpur).

Moving forward, PLife REIT remains committed to exploring and rolling out more of such AEIs across its entire portfolio to extract the greatest value from its properties. To further strengthen PLife REIT's earnings resiliency, it is also focused on consolidation efforts for its Japan portfolio to optimise operating synergies and achieve greater cost savings.

Capital and Financial Management

PLife REIT aims to maintain a strong financial position through prudent and dynamic capital and financial management, to ensure continuous access to funding at optimal cost, maintain stable distributions to Unitholders and achieve a steady net asset value.

As at 31 March 2023, PLife REIT's gearing was 37.5% which complied with the stipulated Aggregate Leverage limit1. The interest coverage ratio stood at 15.6 times2.

Dynamic liability and liquidity risk management

PLife REIT adopts a dynamic and pro-active approach for its liability and liquidity risk management. Our key liability and funding management strategies in support of our regional growth aspirations are:

1) To achieve diversified funding sources at an optimal cost

Diversify our funding sources from a panel of high quality banks, establishing and maintaining our Debt Issuance Programme and other financing sources to attain varied liability tenure, with the end objective of maintaining the most optimal financing cost mix.

2) To enhance the defensiveness of PLife REIT's Balance Sheet strength

Dynamically manage our debt maturity profile to ensure well-spread debt maturities and at the same time, to maintain an optimal capital structure.

Tactical approaches adopted in view of the above strategies are:

a) Conscientious effort in lengthening and spreading out the debt maturity period;

b) Cultivating and maintaining a panel of key banks to support our long term growth;

c) Establishing alternative source of fund. In this respect, PLife REIT, through its wholly-owned subsidiary, Parkway Life MTN Pte Ltd (the “MTN Issuer”), put in place a S$500 million Multicurrency Debt Issuance Programme to provide PLife REIT with the flexibility to tap various types of capital market products including issuance of perpetual securities when needed. On 6 December 2022, the Group issued a 6-year JPY5.0 billion and a maiden 7-year JPY6.04 billion fixed rate notes to pre-emptively refinance existing fixed rate notes due in 2023 and term out the JPY short-term loans drawn down for acquisition financing. As at 31 March 2023, there were five series of outstanding unsecured fixed rate

notes amounted to JPY19.84 billion3 (approximately S$202.6 million) issued under the Debt Issuance Programme, which diversified PLife REIT’s funding sources.

d) Minimising near-term refinancing risk through pre-emptive terming out current debts. With the new notes issuance, PLife REIT has effectively managed its debt maturity profile with no immediate long-term debt refinancing needs until February 2024.

Financial risk management

PLife REIT adopts prudent financial risk management to manage the exposure to interest rate risk and foreign currency risk. Our policy is to hedge at least 50% (up to 100%) of all financial risks.

Interest rate risk is managed on an ongoing basis with the primary objective of limiting the extent to which net interest expenses could be affected by adverse movements in interest rates, by hedging the long term committed borrowings through the use of interest rate hedging financial instruments. For the foreign exchange ("Forex") risk management, we strive to hedge Forex risk on principal which will allow PLife REIT to maintain a stable net asset value, as the Forex fluctuation on foreign asset will offset the Forex fluctuation of the hedging instrument. We also aim to hedge the Forex risk on net overseas income which will provide PLife REIT with stability in distributable income, as PLife REIT will be shielded from exchange rate fluctuation on foreign income.

As at 31 March 2023, the Group has put in place Japanese Yen forward exchange contracts till 1Q 2027 and about 78% of interest rate exposure is hedged.

Chart wise, bearish mode!

Looks like gd price is back!

With bullish pin bar appearing on the chart we may see a throw-back reaction from the current price level of 3.74.

NAV is about 2.33.

Yearly dividend is about 14.5cents.

Yield is about 3.87 % based on current price of 3.74

Not a call to buy or sell!

Please dyodd.

Beer Thai (1991) Public Company Limited

Beer Thai (1991) Public Company Limited