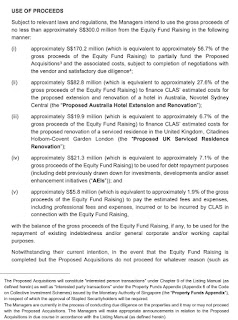

FLCT has a portfolio comprising 107 logistics and commercial properties worth approximately S$6.9 billion, diversified across five major developed countries – Australia, Germany, the United Kingdom, Singapore and the Netherlands.

FLCT’s investment strategy is to invest globally in a diversified portfolio of income producing properties. With strong connectivity to key infrastructure, FLCT’s modern portfolio consists predominantly of freehold and long leasehold land tenure assets with a well-diversified tenant base.

Strategy for Value Creation

FLCT is one of the largest REITs in Singapore with a flagship portfolio of 105 properties in five developed countries. The REIT Manager seeks to harness FLCT’s competitive advantages to deliver stable and regular distributions to unitholders and achieve sustainable long-term growth in DPU.

Acquisition growth

We will continue to source and pursue strategic asset acquisition opportunities of quality properties which provide attractive cash flows and yields that need FLCT's investment mandate. In doing so, we seek to generate stable and growing income streams which will enhance returns to Unitholders. It is our strategy to evaluate investment opportunities in global markets, with focus on FLCT's key markets, where we can leverage on existing on-the-ground management expertise. A measured approach will be taken when evaluating acquisitions which meet FLCT’s investment mandate.

Backed by a strong and established Sponsor, Frasers Property, FLCT is able to leverage on the Sponsor’s strong network and pipeline of quality assets, and also enjoys a Right of First Refusal (“ROFR”) arrangement from the Sponsor. Furthermore, FLCT has the potential to tap into growth opportunities from the Sponsor’s property development pipeline. We carefully assess opportunities that may arise under the ROFR for assets injection, typically when rental income generated by these properties has stabilised, among other factors.

We proactively manage FLCT’s asset portfolio to enhance operational performance, allowing us to optimise the cash flow and value of our properties.

A disciplined and frequent review of asset strategies, involving monitoring market trends; development, occupier and investment dynamics; and a thorough analytics and valuation process, allows us to adjust strategies to take advantage of opportunities and maximise returns. Where appropriate, this may involve divesting and recycling non-core assets.

Our asset managers, when possible, deliver AEIs which are income and value accretive. Similarly, active tenant engagements underpin a significant component of our asset management operations. By leveraging our strong customer relationships and understanding our customers’ business operations, we are able to identify initiatives to better service our customers and provide solutions for greater efficiency and functionality of the properties. In doing so, we seek to achieve healthy tenant retention rates and reduce lease expiry concentration risks.

This allows FLCT to provide Unitholders with the security of income and access to organic growth from built-in rental increments, even though different stages of the economic cycle.

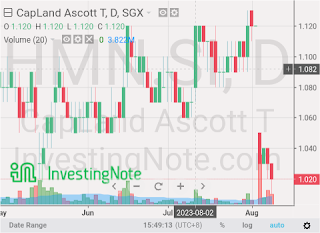

NAV 1.276. Yearly dividend of about 7.29 cents, yield is about 5.9%. Chart wise, bearish mode! I think likely to go down to test 1.19-1.20. Next support is 1.15. Not a call to buy or sell! Please dyodd.