TA wise, looks rather bullish!

It has bounce-off from the double bottom chart patterns and managed to cleared the resistance at $1.21 to close higher at $1.24.

NAV $2.582.

PE of 7.4x.

Dividend of 6 cents.

Short term wise,I think it may likely move up to $1.30.

Breaking out of $1.30 plus good volume that may likely drive the price higher towards $1.40 level.

Not a call to buy or sell.

Pls dyodd.

https://spore-share.com or sporeshare.blogspot.com It is very important to equip and educate ourselves with the Trading or investing knowledge. Don’t rely on tips! Ensure we have a proper plan in place whenever we enter a trade. Don’t speculate and trade without knowing what you are trying to achieve. Only trade when the trading opportunity arise. All information provided is just just for sharing. (Trade/Invest base on your own decision!)

Thursday, April 16, 2020

Wednesday, April 15, 2020

Suntec

Chart wise, she has managed to bounce-off from the low of $1.10 and rises higher to close at $1.31, looks rather positive!

Short term wise, I think a nice breakout of $1.36 plus high volume that may likely propel to drive the price higher towards 1.40 then 1.50 level.

NAV $2.126

P/B 0.616

Dividend let say drop to 8.8 cents. i.e. 2.2 cents per quarter, Yield is about 6.71% based on current price of $1.31, looks pretty attractive!

The recent Share Placement offered price was $1.80 per share.

We are now getting a good discounted price at $1.31.

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think a nice breakout of $1.36 plus high volume that may likely propel to drive the price higher towards 1.40 then 1.50 level.

NAV $2.126

P/B 0.616

Dividend let say drop to 8.8 cents. i.e. 2.2 cents per quarter, Yield is about 6.71% based on current price of $1.31, looks pretty attractive!

The recent Share Placement offered price was $1.80 per share.

We are now getting a good discounted price at $1.31.

Not a call to buy or sell.

Pls dyodd.

CapitaMall trust

Looks like she has found her bottom and bounce off nicely from $1.49 to trade higher at $1.77 level, looks positive!

Short term wise, I think a nice breakout of the recent high of $1.84 would likely bring the price higher towards 1.90 then $2.00.

I think once the current market sentiment improve,she would likely be trading above $2.00.

NAV $2.105.

Lets say DPU drop to 11 cents from 12.2 cents , yield is about 6.2% for this blue chips reit counter, looks quite attractive!

Not a call to buy or sell.

Pls dyodd.

Short term wise, I think a nice breakout of the recent high of $1.84 would likely bring the price higher towards 1.90 then $2.00.

I think once the current market sentiment improve,she would likely be trading above $2.00.

NAV $2.105.

Lets say DPU drop to 11 cents from 12.2 cents , yield is about 6.2% for this blue chips reit counter, looks quite attractive!

Not a call to buy or sell.

Pls dyodd.

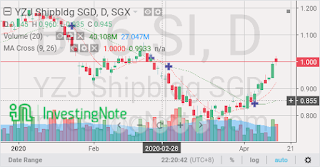

YZJ ShipBldg SGD

TA wise, looks like overly extended!

Likely to see some pulling back reaction from current price level of $1.00.

Short term wise, it may retrace back to 95 then 90 then 85 cents level.

Pls dyodd.

Likely to see some pulling back reaction from current price level of $1.00.

Short term wise, it may retrace back to 95 then 90 then 85 cents level.

Pls dyodd.

Sasseur Reit

It has a nice running up from 53 cents to close higher at 69.5 cents ,looks like overly stretch at this juncture!

Close with a topping tail candlestick seems like fund has managed to offload some of their gains!

I think we may see some selling down pressure!

It might be good to monitor and wait for clearer picture.

Pls dyodd.

Chart wise, it has a temporary rebound from the low of 53 cents to close higher at 62 cents, looks quite positive!

The major resistance is at 65 cents level.

A nice breakout plus high volume that may likely drive the price higher towards 70 then 72.5 cents with extension to 80 cents level.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.83% based on current price of 62 cents.

Not a call to buy or sell.

Pls dyodd.

Close with a topping tail candlestick seems like fund has managed to offload some of their gains!

I think we may see some selling down pressure!

It might be good to monitor and wait for clearer picture.

Pls dyodd.

Chart wise, it has a temporary rebound from the low of 53 cents to close higher at 62 cents, looks quite positive!

The major resistance is at 65 cents level.

A nice breakout plus high volume that may likely drive the price higher towards 70 then 72.5 cents with extension to 80 cents level.

Chongqing and Bishan outlet malls were reopened on 15 March 2020. Sasseur REIT resumes full operations with the reopening of all four outlet malls.Kunming outlet mall was reopened on 11 Mar 2020 and Hefei outlet mall was reopened on 13th Mar 2020.

All outlet malls are back in operations. Looks like we may see 1-2 quarters of disruption of their rental income/ dpu distribution .

NAV of 89 cents.

Not sure what would be the impact for First quarter dpu( Jan - Mar) and Second quarter dpu( April - June). Last year total DPU of 6.53 cents that would translate a dividend yield of 10.5 % based on current price of 62 cents. Given the fact that the 4 outlet malls were close in Jan, DPU for First quarter 2020 would be badly affected. We may see nil or zero DPU for first quarter. 2nd quarter DPu may be much lower as compared to last year .. Same for 3rd and 4th quarter. Estimated yearly DPU for 2020 might be 3 cents that would translate to a dividend yield of 4.83% based on current price of 62 cents.

Not a call to buy or sell.

Pls dyodd.

Monday, April 13, 2020

SGX

Wah, when the STI market is bullish +70 points , she goes the opposite direction!

Down 22 cents to trade at $9.62.

yearly dividend of 30 cents.

Yield is merely 3.1%.

Looks pretty expensive!

I would rather go for OCBC Bank that is trading at $9.10, dividend of 53 cents, yield of 5.82%.

Let's wait for market to tell us the clear direction if she is going to breakdown the lower Trend Line that may see further selling down pressure!

She has a very impressive running up even though when the global stocks market is bearish!

I guess is the Big Boy that are controlling the driver seat!

Once they started to exit , we may see the clearer picture and direction of this counter.

Not a call to buy or sell.

Pls dyodd.

Down 22 cents to trade at $9.62.

yearly dividend of 30 cents.

Yield is merely 3.1%.

Looks pretty expensive!

I would rather go for OCBC Bank that is trading at $9.10, dividend of 53 cents, yield of 5.82%.

Let's wait for market to tell us the clear direction if she is going to breakdown the lower Trend Line that may see further selling down pressure!

She has a very impressive running up even though when the global stocks market is bearish!

I guess is the Big Boy that are controlling the driver seat!

Once they started to exit , we may see the clearer picture and direction of this counter.

Not a call to buy or sell.

Pls dyodd.

Subscribe to:

Comments (Atom)