What would be the Cut Loss/Stop Loss Price for Long/Buy trade - 2nd April 2017

Taking for example for using this counter Singpost .

Purchased price @ $1.365 for 10000 share.

Total amount purchased is $13650 ( excluding brokerage fee etc)

Cut Loss /Stop Loss price depends on your risk profile.

Let say about 5% Cut Loss/Stop Loss price .

We would be looking at the Cut Loss/Stop Loss price at $1.30.

$1.365 less $1.30 = $$0.065 x 10000 share = $650.

$650 divided by $13650 = 4.76%

In this case , your Cut loss amount will be $650 which is approximately close to 5% that you could afford to loss.

Other may have a higher risk appetite and can roughly use 8% Cut Loss as a way to limit your loss.

For 8%, the Cut Loss price will be at $1.255 .

$1.365 less $1.255 = $0.11 x 10000 share = $1100.

$1100 divided by $13650 = 8.05%.

( Trade base on your own decision)

https://spore-share.com or sporeshare.blogspot.com It is very important to equip and educate ourselves with the Trading or investing knowledge. Don’t rely on tips! Ensure we have a proper plan in place whenever we enter a trade. Don’t speculate and trade without knowing what you are trying to achieve. Only trade when the trading opportunity arise. All information provided is just just for sharing. (Trade/Invest base on your own decision!)

Saturday, April 1, 2017

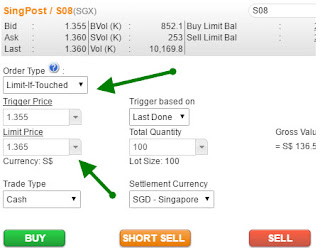

Trading Tools for Long/Buy trade using normal brokerage account

Trading Tools for Long/Buy trade - 2nd April 2017

I personally think this kind of trading tools feature is ideal for those who are using the normal brokerage account as opine to the usual CFD feature.

Not many local brokerage securities is offering this kind of feature.

I think Phillip securities and CIMB trading platform may have this kind of feature to utilize the Long/Buy "Limit-If-Touched" options.

For a trader that would like to set a certain price to buy in this counter - SingPost for example.

He /She may set the limit price to Buy in let say $1.365 for 10000 share.

If the price does not hit $1.365 and above, the limit price will not be executed.

( Trade base on your own decision)

I personally think this kind of trading tools feature is ideal for those who are using the normal brokerage account as opine to the usual CFD feature.

Not many local brokerage securities is offering this kind of feature.

I think Phillip securities and CIMB trading platform may have this kind of feature to utilize the Long/Buy "Limit-If-Touched" options.

For a trader that would like to set a certain price to buy in this counter - SingPost for example.

He /She may set the limit price to Buy in let say $1.365 for 10000 share.

If the price does not hit $1.365 and above, the limit price will not be executed.

( Trade base on your own decision)

Thursday, March 30, 2017

METRO

METRO - 30th Mar 2017

Metro had a very impressive running up today and hit the all time high of $1.195. Couple with high volume this is rather positive.

Both Macd & Rsi are still rising of which may provide further indication that the share price may continue to trend higher.

NAV $1.63.

EPS 0.137

PE 8.7x

Short term wise, I think it may likely continue to move up to test $1.20 then $1.25 with extension to $1.30 and above.

( trade base on your own decision)

Metro had a very impressive running up today and hit the all time high of $1.195. Couple with high volume this is rather positive.

Both Macd & Rsi are still rising of which may provide further indication that the share price may continue to trend higher.

NAV $1.63.

EPS 0.137

PE 8.7x

Short term wise, I think it may likely continue to move up to test $1.20 then $1.25 with extension to $1.30 and above.

( trade base on your own decision)

Friday, March 24, 2017

China Sunsine

China Sunsine = 24th Mar 2017

China Sunsine after touching the low of 51 cents on 18th Jan 2017, it had manged to stage a strong rebound and head higher to touch 64 cents on 23rd Mar 2017. This is rather positive.

Both Macd & Rsi are still rising which may provide further indication that the share price may continue to trend higher.

Short term wise , I think it may make another attempt to re-test the recent high of 64 cents. Crossing over 64 cents with ease that may propel to drive the share price higher towards 70 cents then 75 with extension to 80 cents.

( trade base on your own decision)

China Sunsine after touching the low of 51 cents on 18th Jan 2017, it had manged to stage a strong rebound and head higher to touch 64 cents on 23rd Mar 2017. This is rather positive.

Both Macd & Rsi are still rising which may provide further indication that the share price may continue to trend higher.

Short term wise , I think it may make another attempt to re-test the recent high of 64 cents. Crossing over 64 cents with ease that may propel to drive the share price higher towards 70 cents then 75 with extension to 80 cents.

( trade base on your own decision)

Hi-P International

Hi-P International - 24th Mar 2017

Hi-P International after hitting the low of 47 cents on 20th Jan 2017, it has since stage a strong recovery and head higher to touch 70 cents on 23rd Mar 2017. Couple with high volume this is generally quite positive.

Today it had a wide bearish candlestick and closed lower at 66 cents. This may not bode well for the share price going forward.

Short term wise, I think it may likely consolidate before setting for the next direction.

It might be a good idea to lock in profit at this particular point of time.

( trade base on your own decision)

Hi-P International after hitting the low of 47 cents on 20th Jan 2017, it has since stage a strong recovery and head higher to touch 70 cents on 23rd Mar 2017. Couple with high volume this is generally quite positive.

Today it had a wide bearish candlestick and closed lower at 66 cents. This may not bode well for the share price going forward.

Short term wise, I think it may likely consolidate before setting for the next direction.

It might be a good idea to lock in profit at this particular point of time.

( trade base on your own decision)

Friday, March 17, 2017

Serial System

Serial System - 18th Mar 2017

Serial System has been in a neutral zone for the past 9 months ( June 2016 to Mar 2017) fluctuating within the price range of 13 to 14 cents.

The recent buying activities has been increasing picked up with high volume is mainly attributed to the buying up of share by one of the major share holder.

The buying back started since 10th Mar 2017 with various prices from 14.9 to 16.6 cents.

You may refer to sgx announcement about the share buying back statement.

From TA point of view, it has now crossing over this neutral zone and is gaining strength to trend upwards. This is generally quite bullish.

Last Friday it had a nice follow-through white thrust bar and went up to touch 16.8 cents and closed well at 16.7 cents. Couple with high volume this is generally quite positive.

The immediate resistance is at 16.9/17 cents. Breaking out of 17 cents with ease will be positive to drive the share price higher towards 19.9 cents /20.5 cents.

( trade base on your own decision)

Serial System has been in a neutral zone for the past 9 months ( June 2016 to Mar 2017) fluctuating within the price range of 13 to 14 cents.

The recent buying activities has been increasing picked up with high volume is mainly attributed to the buying up of share by one of the major share holder.

The buying back started since 10th Mar 2017 with various prices from 14.9 to 16.6 cents.

You may refer to sgx announcement about the share buying back statement.

From TA point of view, it has now crossing over this neutral zone and is gaining strength to trend upwards. This is generally quite bullish.

Last Friday it had a nice follow-through white thrust bar and went up to touch 16.8 cents and closed well at 16.7 cents. Couple with high volume this is generally quite positive.

The immediate resistance is at 16.9/17 cents. Breaking out of 17 cents with ease will be positive to drive the share price higher towards 19.9 cents /20.5 cents.

( trade base on your own decision)

Subscribe to:

Posts (Atom)