Update: NikkoAM-STC Asia REIT - Having this counter is like investing in most of the famous reit like MIT, CAR, MPAT, KDC, CICT, LiNK Nice yield of about 5.9% at 83.8 cents. Quarterly dividend, nice!

Chart wise bullish mode!

A nice V shape recovery!

She is goung ex.dividend on 2nd Jan 2024 for 1.17 cents. This might present an opportunity to buy on dip or further weakness.

Pls dyodd.

Wah, nice closing at 82 cents!

I think high chance she may rise up to test 84 cents Than 88.5 cents!

Pls dyodd.

9th December 2023:

Chart wise, bullish mode!

I think likely to clear 82 cents and rises higher to test 84-84.5 cents.

A nice breakout smoothly will likely see her rising up to test 90 cents.

Pls dyodd.

I think she is slowly gaining momentum and likely to rise up further as US interest rate has peaked and paused and this is generally positive for reit and equity!

I think high probability of rising up to test 84 cents than 90 cents.

Pls dyodd.

Nibbled a bit at 0.801. Nice yield of more than 6%!

Chart wise, she is slowly recovering from the low of 0.73+ looks rather positive!

Pls dyodd.

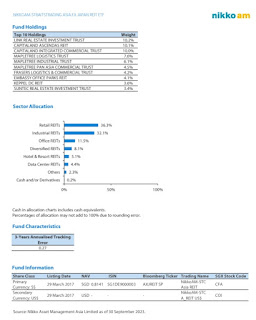

NikkoAM-STC Asia REIT ETF (CFA.SI) - She is yielding 6.49% at 0.801, Quarterly dividend, I think is a good yield level to take note!

It covers most of the index reit like CapitaLand Integrated Commercial Trust, CapitaLand Ascendas REIT, Mapletree Ind Tr, Mapletree Logistics Trust, Frasers L&C Tr etc.

Chart wise, it has managed to bounce-off from the low of 73.6 cents and closed well at 0.802, looks rather bullish!

If this bullish momentum continue we may likely see her rising up further towards 90 cents and above.

Not a call to buy or sell!

Please dyodd.

No comments:

Post a Comment